Page 62 - NobleCon21

P. 62

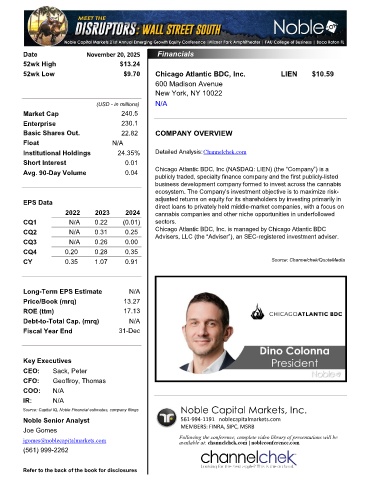

Financials

Date November 20, 2025 Financials

52wk High $13.24

52wk Low $9.70 Chicago Atlantic BDC, Inc. LIEN $10.59

600 Madison Avenue

New York, NY 10022

(USD - in millions) N/A

Market Cap 240.5

Enterprise 230.1

Basic Shares Out. 22.82 COMPANY OVERVIEW

Float N/A

Institutional Holdings 24.35% Detailed Analysis:Channelchek.com

Short Interest 0.01

Avg. 90-Day Volume 0.04 Chicago Atlantic BDC, Inc (NASDAQ: LIEN) (the “Company”) is a

publicly traded, specialty finance company and the first publicly-listed

business development company formed to invest across the cannabis

ecosystem. The Company’s investment objective is to maximize risk-

EPS Data adjusted returns on equity for its shareholders by investing primarily in

direct loans to privately held middle-market companies, with a focus on

2022 2023 2024 cannabis companies and other niche opportunities in underfollowed

CQ1 N/A 0.22 (0.01) sectors.

CQ2 N/A 0.31 0.25 Chicago Atlantic BDC, Inc. is managed by Chicago Atlantic BDC

Advisers, LLC (the “Adviser”), an SEC-registered investment adviser.

CQ3 N/A 0.26 0.00

CQ4 0.20 0.28 0.35

CY 0.35 1.07 0.91 Source: Channelchek/QuoteMedia

Long-Term EPS Estimate N/A

Price/Book (mrq) 13.27

ROE (ttm) 17.13

Debt-to-Total Cap. (mrq) N/A

Fiscal Year End 31-Dec

600 Madison ANew York NY 10022

Key Executives

CEO: Sack, Peter

CFO: Geoffroy, Thomas

COO: N/A

IR: N/A

Noble Capital Markets, Inc.

Source: Capital IQ, Noble Financial estimates, company filings

Noble Senior Analyst 561-994-1191 noblecapitalmarkets.com

Joe Gomes MEMBERS: FINRA, SIPC, MSRB

jgomes@noblecapitalmarkets.com Following the conference, complete video library of presentations will be

available at: channelchek.com | nobleconference.com

(561) 999-2262

Refer to the back of the book for disclosures