Page 10 - 2Q2021 RETAIL WEALTH ADVISORY Playbook

P. 10

Portfolio Building Blocks

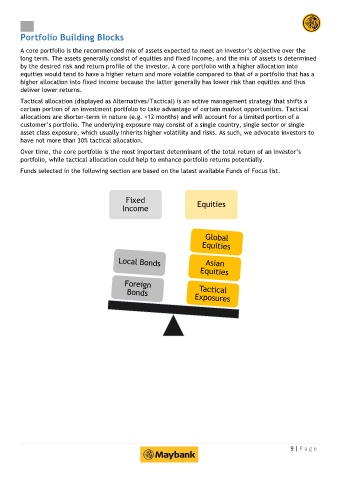

A core portfolio is the recommended mix of assets expected to meet an investor’s objective over the

long term. The assets generally consist of equities and fixed income, and the mix of assets is determined

by the desired risk and return profile of the investor. A core portfolio with a higher allocation into

equities would tend to have a higher return and more volatile compared to that of a portfolio that has a

higher allocation into fixed income because the latter generally has lower risk than equities and thus

deliver lower returns.

Tactical allocation (displayed as Alternatives/Tactical) is an active management strategy that shifts a

certain portion of an investment portfolio to take advantage of certain market opportunities. Tactical

allocations are shorter-term in nature (e.g. <12 months) and will account for a limited portion of a

customer’s portfolio. The underlying exposure may consist of a single country, single sector or single

asset class exposure, which usually inherits higher volatility and risks. As such, we advocate investors to

have not more than 30% tactical allocation.

Over time, the core portfolio is the most important determinant of the total return of an investor’s

portfolio, while tactical allocation could help to enhance portfolio returns potentially.

Funds selected in the following section are based on the latest available Funds of Focus list.

Fixed

Income Equities

9 | P a g e