Page 8 - 2Q2021 RETAIL WEALTH ADVISORY Playbook

P. 8

Region / Previous Current Deliberation

Country Stance Stance

Effective implementation of a vaccine programme is key

to curb further impact from COVID-19, which prevents us

from turning overly optimistic on the market.

Source: Maybank Group Wealth Management Research, Maybank Kim Eng.

Note: Rows highlighted in yellow indicates changes in stance.

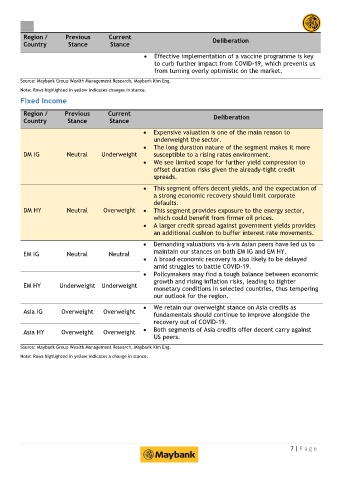

Fixed Income

Region / Previous Current Deliberation

Country Stance Stance

Expensive valuation is one of the main reason to

underweight the sector.

The long duration nature of the segment makes it more

DM IG Neutral Underweight susceptible to a rising rates environment.

We see limited scope for further yield compression to

offset duration risks given the already-tight credit

spreads.

This segment offers decent yields, and the expectation of

a strong economic recovery should limit corporate

defaults.

DM HY Neutral Overweight This segment provides exposure to the energy sector,

which could benefit from firmer oil prices.

A larger credit spread against government yields provides

an additional cushion to buffer interest rate movements.

Demanding valuations vis-à-vis Asian peers have led us to

EM IG Neutral Neutral maintain our stances on both EM IG and EM HY.

A broad economic recovery is also likely to be delayed

amid struggles to battle COVID-19.

Policymakers may find a tough balance between economic

growth and rising inflation risks, leading to tighter

EM HY Underweight Underweight monetary conditions in selected countries, thus tempering

our outlook for the region.

We retain our overweight stance on Asia credits as

Asia IG Overweight Overweight fundamentals should continue to improve alongside the

recovery out of COVID-19.

Asia HY Overweight Overweight Both segments of Asia credits offer decent carry against

US peers.

Source: Maybank Group Wealth Management Research, Maybank Kim Eng.

Note: Rows highlighted in yellow indicates a change in stance.

7 | P a g e