Page 5 - 2Q2021 RETAIL WEALTH ADVISORY Playbook

P. 5

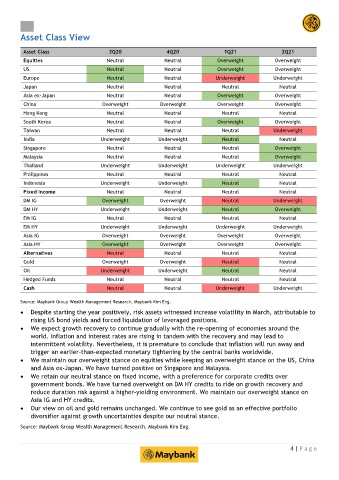

Asset Class View

Asset Class 3Q20 4Q20 1Q21 2Q21

Equities Neutral Neutral Overweight Overweight

US Neutral Neutral Overweight Overweight

Europe Neutral Neutral Underweight Underweight

Japan Neutral Neutral Neutral Neutral

Asia ex-Japan Neutral Neutral Overweight Overweight

China Overweight Overweight Overweight Overweight

Hong Kong Neutral Neutral Neutral Neutral

South Korea Neutral Neutral Overweight Overweight

Taiwan Neutral Neutral Neutral Underweight

India Underweight Underweight Neutral Neutral

Singapore Neutral Neutral Neutral Overweight

Malaysia Neutral Neutral Neutral Overweight

Thailand Underweight Underweight Underweight Underweight

Philippines Neutral Neutral Neutral Neutral

Indonesia Underweight Underweight Neutral Neutral

Fixed Income Neutral Neutral Neutral Neutral

DM IG Overweight Overweight Neutral Underweight

DM HY Underweight Underweight Neutral Overweight

EM IG Neutral Neutral Neutral Neutral

EM HY Underweight Underweight Underweight Underweight

Asia IG Overweight Overweight Overweight Overweight

Asia HY Overweight Overweight Overweight Overweight

Alternatives Neutral Neutral Neutral Neutral

Gold Overweight Overweight Neutral Neutral

Oil Underweight Underweight Neutral Neutral

Hedged Funds Neutral Neutral Neutral Neutral

Cash Neutral Neutral Underweight Underweight

Source: Maybank Group Wealth Management Research, Maybank Kim Eng.

Despite starting the year positively, risk assets witnessed increase volatility in March, attributable to

rising US bond yields and forced liquidation of leveraged positions.

We expect growth recovery to continue gradually with the re-opening of economies around the

world. Inflation and interest rates are rising in tandem with the recovery and may lead to

intermittent volatility. Nevertheless, it is premature to conclude that inflation will run away and

trigger an earlier-than-expected monetary tightening by the central banks worldwide.

We maintain our overweight stance on equities while keeping an overweight stance on the US, China

and Asia ex-Japan. We have turned positive on Singapore and Malaysia.

We retain our neutral stance on fixed income, with a preference for corporate credits over

government bonds. We have turned overweight on DM HY credits to ride on growth recovery and

reduce duration risk against a higher-yielding environment. We maintain our overweight stance on

Asia IG and HY credits.

Our view on oil and gold remains unchanged. We continue to see gold as an effective portfolio

diversifier against growth uncertainties despite our neutral stance.

Source: Maybank Group Wealth Management Research, Maybank Kim Eng.

4 | P a g e