Page 6 - 2Q2021 RETAIL WEALTH ADVISORY Playbook

P. 6

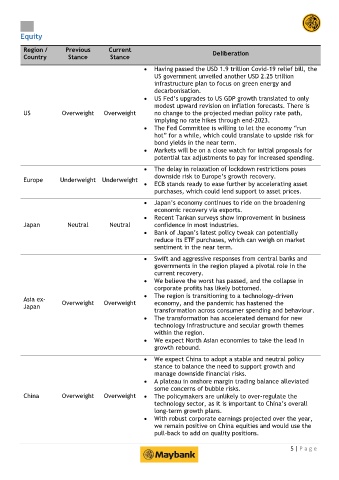

Equity

Region / Previous Current Deliberation

Country Stance Stance

Having passed the USD 1.9 trillion Covid-19 relief bill, the

US government unveiled another USD 2.25 trillion

infrastructure plan to focus on green energy and

decarbonisation.

US Fed’s upgrades to US GDP growth translated to only

modest upward revision on inflation forecasts. There is

US Overweight Overweight no change to the projected median policy rate path,

implying no rate hikes through end-2023.

The Fed Committee is willing to let the economy “run

hot” for a while, which could translate to upside risk for

bond yields in the near term.

Markets will be on a close watch for initial proposals for

potential tax adjustments to pay for increased spending.

The delay in relaxation of lockdown restrictions poses

downside risk to Europe’s growth recovery.

Europe Underweight Underweight

ECB stands ready to ease further by accelerating asset

purchases, which could lend support to asset prices.

Japan’s economy continues to ride on the broadening

economic recovery via exports.

Recent Tankan surveys show improvement in business

Japan Neutral Neutral confidence in most industries.

Bank of Japan’s latest policy tweak can potentially

reduce its ETF purchases, which can weigh on market

sentiment in the near term.

Swift and aggressive responses from central banks and

governments in the region played a pivotal role in the

current recovery.

We believe the worst has passed, and the collapse in

corporate profits has likely bottomed.

The region is transitioning to a technology-driven

Asia ex- Overweight Overweight

Japan economy, and the pandemic has hastened the

transformation across consumer spending and behaviour.

The transformation has accelerated demand for new

technology infrastructure and secular growth themes

within the region.

We expect North Asian economies to take the lead in

growth rebound.

We expect China to adopt a stable and neutral policy

stance to balance the need to support growth and

manage downside financial risks.

A plateau in onshore margin trading balance alleviated

some concerns of bubble risks.

China Overweight Overweight The policymakers are unlikely to over-regulate the

technology sector, as it is important to China’s overall

long-term growth plans.

With robust corporate earnings projected over the year,

we remain positive on China equities and would use the

pull-back to add on quality positions.

5 | P a g e