Page 7 - 2Q2021 RETAIL WEALTH ADVISORY Playbook

P. 7

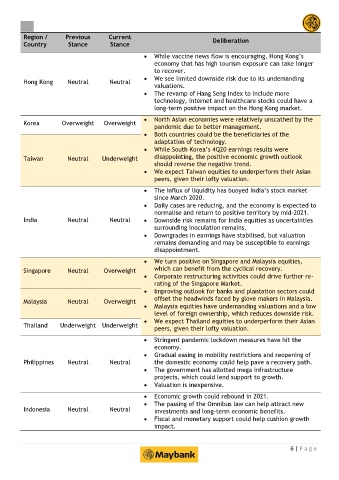

Region / Previous Current Deliberation

Country Stance Stance

While vaccine news flow is encouraging, Hong Kong’s

economy that has high tourism exposure can take longer

to recover.

We see limited downside risk due to its undemanding

Hong Kong Neutral Neutral

valuations.

The revamp of Hang Seng Index to include more

technology, internet and healthcare stocks could have a

long-term positive impact on the Hong Kong market.

North Asian economies were relatively unscathed by the

Korea Overweight Overweight

pandemic due to better management.

Both countries could be the beneficiaries of the

adaptation of technology.

While South Korea’s 4Q20 earnings results were

Taiwan Neutral Underweight disappointing, the positive economic growth outlook

should reverse the negative trend.

We expect Taiwan equities to underperform their Asian

peers, given their lofty valuation.

The influx of liquidity has buoyed India’s stock market

since March 2020.

Daily cases are reducing, and the economy is expected to

normalise and return to positive territory by mid-2021.

India Neutral Neutral Downside risk remains for India equities as uncertainties

surrounding inoculation remains.

Downgrades in earnings have stabilised, but valuation

remains demanding and may be susceptible to earnings

disappointment.

We turn positive on Singapore and Malaysia equities,

Singapore Neutral Overweight which can benefit from the cyclical recovery.

Corporate restructuring activities could drive further re-

rating of the Singapore Market.

Improving outlook for banks and plantation sectors could

Malaysia Neutral Overweight offset the headwinds faced by glove makers in Malaysia.

Malaysia equities have undemanding valuations and a low

level of foreign ownership, which reduces downside risk.

We expect Thailand equities to underperform their Asian

Thailand Underweight Underweight peers, given their lofty valuation.

Stringent pandemic lockdown measures have hit the

economy.

Gradual easing in mobility restrictions and reopening of

Philippines Neutral Neutral the domestic economy could help pave a recovery path.

The government has allotted mega infrastructure

projects, which could lend support to growth.

Valuation is inexpensive.

Economic growth could rebound in 2021.

The passing of the Omnibus law can help attract new

Indonesia Neutral Neutral investments and long-term economic benefits.

Fiscal and monetary support could help cushion growth

impact.

6 | P a g e