Page 22 - FY 20 Annual Report: Land Trusts Protection & Advocacy Office

P. 22

Schedule of SITFO Expenditures Calendar Performance

Figure 4: Calendar Performance

30.0%

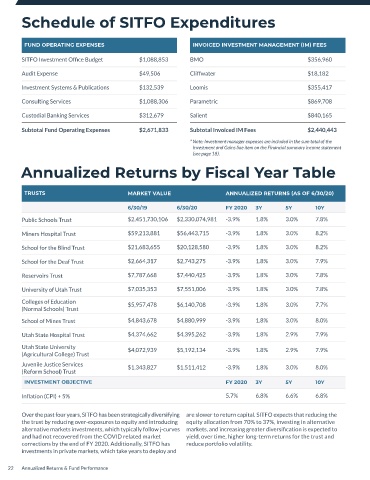

FUND OPERATING EXPENSES INVOICED INVESTMENT MANAGEMENT (IM) FEES

20.0%

SITFO Investment Office Budget $1,088,853 BMO $356,960

10.0% Figure 4: Calendar Performance

Audit Expense $49,506 Cliffwater $18,182

30.0%

Investment Systems & Publications $132,539 Loomis $355,417 0.0%

20.0%

Consulting Services $1,088,306 Parametric $869,708 -10.0%

10.0%

Custodial Banking Services $312,679 Salient $840,165 -20.0%

0.0%

Subtotal Fund Operating Expenses $2,671,833 Subtotal Invoiced IM Fees $2,440,443 -30.0%

2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008

* Note: Investment manager expenses are included in the sum total of the -10.0%

Investment and Gains line item on the Financial summary income statement Total Fund -3.9% 12.0% -4.0% 10.4% 5.9% 2.2% 8.7% 20.2% 13.5% 2.3% 12.1% 19.8% -26.0%

(see page 18). -20.0%

CPI + 5%

Annualized Returns by Fiscal Year Table -30.0% 2020 5.7% 7.1% 7.1% 5.6% 5.8% 6.7% 6.8% 8.0% 6.4% 8.0% 5.9% 6.7% 7.4%

2019

2018

2017

2009

2008

2010

2016

2014

2013

2012

2011

2015

The above chart displays the calendar year performance and

Total Fund -3.9% 12.0% -4.0% 10.4% 5.9% 2.2% 8.7% 20.2% 13.5% 2.3% 12.1% 19.8% -26.0%

TRUSTS MARKET VALUE ANNUALIZED RETURNS (AS OF 6/30/20) highlights the volatility of the portfolio. The diversification into

alternative investments such as private markets are expected to

CPI + 5% 5.7% 7.1% 7.1% 5.6% 5.8% 6.7% 6.8% 8.0% 6.4% 8.0% 5.9% 6.7% 7.4%

6/30/19 6/30/20 FY 2020 3Y 5Y 10Y mitigate this volatility as well as enhance returns.

Public Schools Trust $2,451,730,106 $2,330,074,981 -3.9% 1.8% 3.0% 7.8%

Figure 4: Calendar Performance

Miners Hospital Trust $59,213,881 $56,443,715 -3.9% 1.8% 3.0% 8.2% Rolling 5-Year Performance

School for the Blind Trust $21,683,655 $20,128,580 -3.9% 1.8% 3.0% 8.2% 20.0%

15.0%

School for the Deaf Trust $2,664,317 $2,743,275 -3.9% 1.8% 3.0% 7.9% vs. Investment Objective

10.0% Figure 4: Calendar Performance

Reservoirs Trust $7,787,668 $7,440,425 -3.9% 1.8% 3.0% 7.8%

20.0%

University of Utah Trust $7,035,353 $7,551,006 -3.9% 1.8% 3.0% 7.8% 5.0%

15.0%

Colleges of Education $5,957,478 $6,140,708 -3.9% 1.8% 3.0% 7.7% 0.0%

(Normal Schools) Trust 10.0%

School of Mines Trust $4,843,678 $4,880,999 -3.9% 1.8% 3.0% 8.0% -5.0%

5.0%

Utah State Hospital Trust $4,374,662 $4,395,262 -3.9% 1.8% 2.9% 7.9%

0.0% 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008

Utah State University $4,072,939 $5,192,134 -3.9% 1.8% 2.9% 7.9%

(Agricultural College) Trust -5.0% SITFO CPI + 5%

Juvenile Justice Services $1,343,827 $1,511,412 -3.9% 1.8% 3.0% 8.0%

(Reform School) Trust

2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008

INVESTMENT OBJECTIVE FY 2020 3Y 5Y 10Y

SITFO CPI + 5%

Inflation (CPI) + 5% 5.7% 6.8% 6.6% 6.8%

Over the past four years, SITFO has been strategically diversifying are slower to return capital. SITFO expects that reducing the The above chart displays the longer-term returns of the trusts

the trust by reducing over-exposures to equity and introducing equity allocation from 70% to 37%, investing in alternative and highlights the cyclical nature of investing. Diversification

alternative markets investments, which typically follow j-curves markets, and increasing greater diversification is expected to and long-term investing require patience during periods of

and had not recovered from the COVID related market yield, over time, higher long-term returns for the trust and underperformance. Importantly, SITFO’s objectives are best

corrections by the end of FY 2020. Additionally, SITFO has reduce portfolio volatility. considered over an investment cycle and with the full context of

investments in private markets, which take years to deploy and the long-term investment program.

22 Annualized Returns & Fund Performance Annualized Returns & Fund Performance 23