Page 8 - Luminex 2018 Be Healthy 12pg with Notices v4_Neat

P. 8

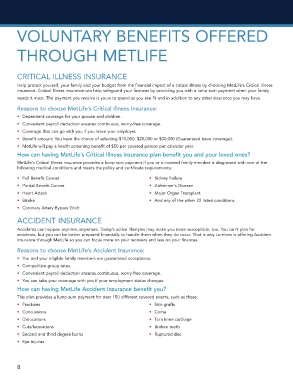

VOLUNTARY BENEFITS OFFERED

THROUGH METLIFE

CRITICAL ILLNESS INSURANCE

Help protect yourself, your family and your budget from the financial impact of a critical illness by choosing MetLife’s Critical Illness

insurance. Critical Illness insurance can help safeguard your finances by providing you with a lump-sum payment when your family

needs it most. The payment you receive is yours to spend as you see fit and in addition to any other insurance you may have.

Reasons to choose MetLife’s Critical Illness Insurance:

• Dependent coverage for your spouse and children.

• Convenient payroll deduction ensures continuous, worry-free coverage.

• Coverage that can go with you if you leave your employer.

• Benefit amount: You have the choice of selecting $10,000, $20,000 or $30,000 (Guaranteed Issue coverage).

• MetLife will pay a health screening benefit of $50 per covered person per calendar year.

How can having MetLife’s Critical Illness insurance plan benefit you and your loved ones?

MetLife’s Critical Illness insurance provides a lump-sum payment if you or a covered family member is diagnosed with one of the

following medical conditions and meets the policy and certificate requirements:

• Full Benefit Cancer • Kidney Failure

• Partial Benefit Cancer • Alzheimer’s Disease

• Heart Attack • Major Organ Transplant

• Stroke • And any of the other 22 listed conditions

• Coronary Artery Bypass Graft

ACCIDENT INSURANCE

Accidents can happen anytime, anywhere. Today’s active lifestyles may make you more susceptible, too. You can’t plan for

accidents, but you can be better prepared financially to handle them when they do occur. That is why Luminex is offering Accident

Insurance through MetLife so you can focus more on your recovery and less on your finances.

Reasons to choose MetLife’s Accident Insurance:

• You and your eligible family members are guaranteed acceptance.

• Competitive group rates.

• Convenient payroll deduction ensures continuous, worry-free coverage.

• You can take your coverage with you if your employment status changes.

How can having MetLife Accident Insurance benefit you?

This plan provides a lump-sum payment for over 150 different covered events, such as these:

• Fractures • Skin grafts

• Concussions • Coma

• Dislocations • Torn knee cartilage

• Cuts/lacerations • Broken teeth

• Second and third degree burns • Ruptured disc

• Eye injuries

8