Page 51 - Site Visit

P. 51

3/8/2021

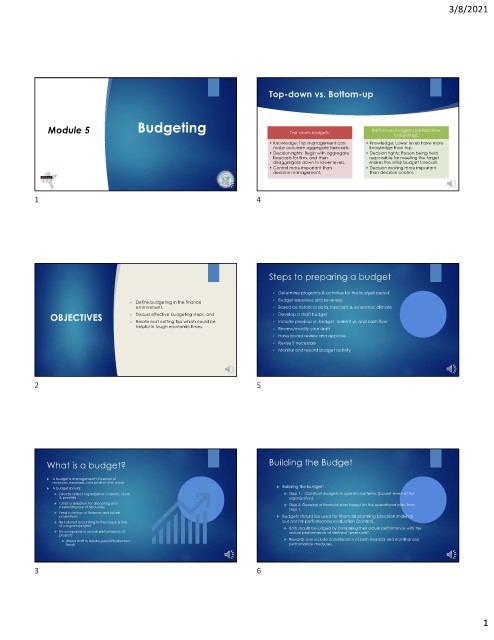

Top-down vs. Bottom-up

Module 5 Budgeting Top-down budgets: Bottom-up budgets (participative

budgeting):

• Knowledge: Top management can • Knowledge: Lower levels have more

make accurate aggregate forecasts. knowledge than top.

• Decision rights: Begin with aggregate • Decision rights: Person being held

forecasts for firm, and then responsible for meeting the target

disaggregate down to lower levels. makes the initial budget forecast.

• Control more important than • Decision making more important

decision management. than decision control.

1 4

Steps to preparing a budget

Determine programs & activities for the budget period

Budget expenses and revenues

Define budgeting in the finance

environment, Based on historical data, forecasts & economic climate

OBJECTIVES Discuss effective budgeting steps, and Develop a draft budget

Relate cost cutting tips which could be Include previous yr. budget, current yr. and cash flow

helpful in tough economic times. Review/modify your draft

Have board review and approve

Revise if necessary

Monitor and record budget activity

2 5

What is a budget? Building the Budget

A budget is management’s forecast of

revenues, expenses, and profits in the future.

A budget should: Building the budget:

Directly reflect organization’s mission, vision Step 1 : Construct budgets in operational terms (Lowest levels of the

& priorities organization).

Chart a direction for allocating and Step 2: Develop a financial plan based on the operational plan from

maximizing use of resources Step 1.

Tend to history of finances and future

projections Budgets should be used for financial planning (decision making),

Be tailored according to the scope & size but not for performance evaluation (control).

of program/project Units should be judged by comparing their actual performance with the

Be compared to actual performance of actual performance of defined “peer units”.

projects

Allows staff to isolate gaps/misdirected Rewards can include consideration of both financial and non-financial

funds performance measures.

3 6

1