Page 22 - ROMA Supplemental Materials

P. 22

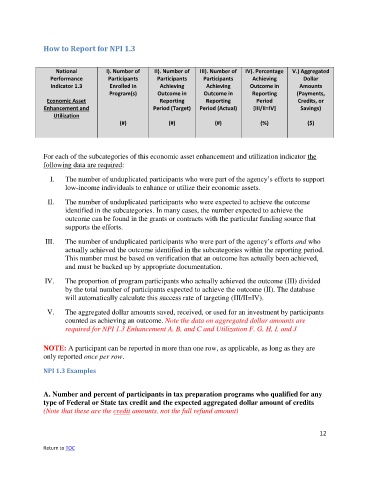

How to Report for NPI 1.3

National I). Number of II). Number of III). Number of IV). Percentage V.) Aggregated

Performance Participants Participants Participants Achieving Dollar

Indicator 1.3 Enrolled in Achieving Achieving Outcome in Amounts

Program(s) Outcome in Outcome in Reporting (Payments,

Economic Asset Reporting Reporting Period Credits, or

Enhancement and Period (Target) Period (Actual) [III/II=IV] Savings)

Utilization

(#) (#) (#) (%) ($)

For each of the subcategories of this economic asset enhancement and utilization indicator the

following data are required:

I. The number of unduplicated participants who were part of the agency’s efforts to support

low-income individuals to enhance or utilize their economic assets.

II. The number of unduplicated participants who were expected to achieve the outcome

identified in the subcategories. In many cases, the number expected to achieve the

outcome can be found in the grants or contracts with the particular funding source that

supports the efforts.

III. The number of unduplicated participants who were part of the agency’s efforts and who

actually achieved the outcome identified in the subcategories within the reporting period.

This number must be based on verification that an outcome has actually been achieved,

and must be backed up by appropriate documentation.

IV. The proportion of program participants who actually achieved the outcome (III) divided

by the total number of participants expected to achieve the outcome (II). The database

will automatically calculate this success rate of targeting (III/II=IV).

V. The aggregated dollar amounts saved, received, or used for an investment by participants

counted as achieving an outcome. Note the data on aggregated dollar amounts are

required for NPI 1.3 Enhancement A, B, and C and Utilization F, G, H, I, and J

NOTE: A participant can be reported in more than one row, as applicable, as long as they are

only reported once per row.

NPI 1.3 Examples

A. Number and percent of participants in tax preparation programs who qualified for any

type of Federal or State tax credit and the expected aggregated dollar amount of credits

(Note that these are the credit amounts, not the full refund amount)

12

Return to TOC