Page 140 - Internal Auditing Standards

P. 140

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

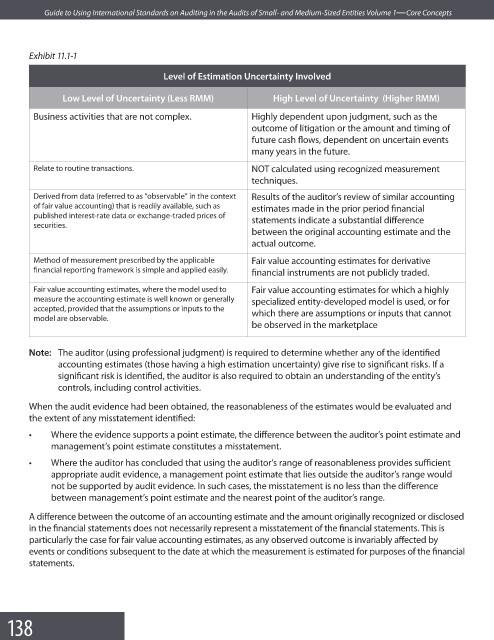

Exhibit 11.1-1

Level of Estimation Uncertainty Involved

Low Level of Uncertainty (Less RMM) High Level of Uncertainty (Higher RMM)

Business activities that are not complex. Highly dependent upon judgment, such as the

outcome of litigation or the amount and timing of

future cash flows, dependent on uncertain events

many years in the future.

Relate to routine transactions. NOT calculated using recognized measurement

techniques.

Derived from data (referred to as “observable” in the context Results of the auditor’s review of similar accounting

of fair value accounting) that is readily available, such as estimates made in the prior period fi nancial

published interest-rate data or exchange-traded prices of statements indicate a substantial diff erence

securities.

between the original accounting estimate and the

actual outcome.

Method of measurement prescribed by the applicable Fair value accounting estimates for derivative

financial reporting framework is simple and applied easily. financial instruments are not publicly traded.

Fair value accounting estimates, where the model used to Fair value accounting estimates for which a highly

measure the accounting estimate is well known or generally specialized entity-developed model is used, or for

accepted, provided that the assumptions or inputs to the which there are assumptions or inputs that cannot

model are observable.

be observed in the marketplace

Note: The auditor (using professional judgment) is required to determine whether any of the identifi ed

accounting estimates (those having a high estimation uncertainty) give rise to significant risks. If a

significant risk is identified, the auditor is also required to obtain an understanding of the entity’s

controls, including control activities.

When the audit evidence had been obtained, the reasonableness of the estimates would be evaluated and

the extent of any misstatement identifi ed:

• Where the evidence supports a point estimate, the difference between the auditor’s point estimate and

management’s point estimate constitutes a misstatement.

• Where the auditor has concluded that using the auditor’s range of reasonableness provides suffi cient

appropriate audit evidence, a management point estimate that lies outside the auditor’s range would

not be supported by audit evidence. In such cases, the misstatement is no less than the diff erence

between management’s point estimate and the nearest point of the auditor’s range.

A difference between the outcome of an accounting estimate and the amount originally recognized or disclosed

in the financial statements does not necessarily represent a misstatement of the financial statements. This is

particularly the case for fair value accounting estimates, as any observed outcome is invariably aff ected by

events or conditions subsequent to the date at which the measurement is estimated for purposes of the fi nancial

statements.

138