Page 143 - Internal Auditing Standards

P. 143

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

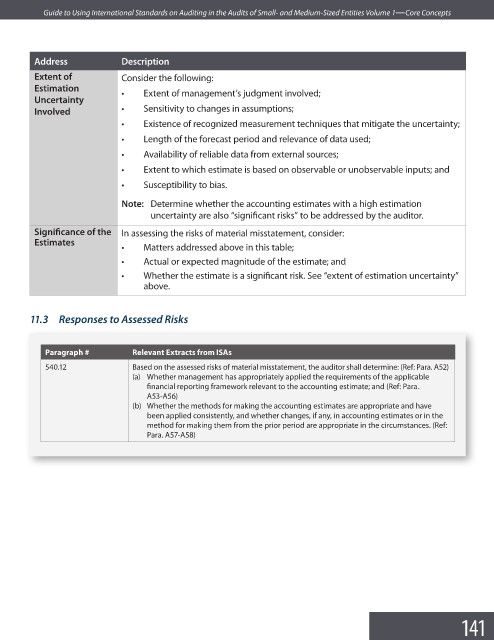

Address Description

Extent of Consider the following:

Estimation

• Extent of management’s judgment involved;

Uncertainty

Involved • Sensitivity to changes in assumptions;

• Existence of recognized measurement techniques that mitigate the uncertainty;

• Length of the forecast period and relevance of data used;

• Availability of reliable data from external sources;

• Extent to which estimate is based on observable or unobservable inputs; and

• Susceptibility to bias.

Note: Determine whether the accounting estimates with a high estimation

uncertainty are also “significant risks” to be addressed by the auditor.

Significance of the In assessing the risks of material misstatement, consider:

Estimates

• Matters addressed above in this table;

• Actual or expected magnitude of the estimate; and

• Whether the estimate is a significant risk. See “extent of estimation uncertainty”

above.

11.3 Responses to Assessed Risks

Paragraph # Relevant Extracts from ISAs

540.12 Based on the assessed risks of material misstatement, the auditor shall determine: (Ref: Para. A52)

(a) Whether management has appropriately applied the requirements of the applicable

financial reporting framework relevant to the accounting estimate; and (Ref: Para.

A53-A56)

(b) Whether the methods for making the accounting estimates are appropriate and have

been applied consistently, and whether changes, if any, in accounting estimates or in the

method for making them from the prior period are appropriate in the circumstances. (Ref:

Para. A57-A58)

141