Page 141 - Internal Auditing Standards

P. 141

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

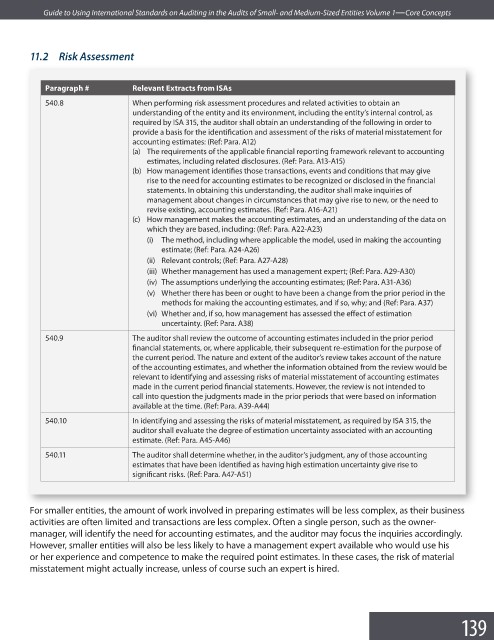

11.2 Risk Assessment

Paragraph # Relevant Extracts from ISAs

540.8 When performing risk assessment procedures and related activities to obtain an

understanding of the entity and its environment, including the entity’s internal control, as

required by ISA 315, the auditor shall obtain an understanding of the following in order to

provide a basis for the identification and assessment of the risks of material misstatement for

accounting estimates: (Ref: Para. A12)

(a) The requirements of the applicable financial reporting framework relevant to accounting

estimates, including related disclosures. (Ref: Para. A13-A15)

(b) How management identifies those transactions, events and conditions that may give

rise to the need for accounting estimates to be recognized or disclosed in the fi nancial

statements. In obtaining this understanding, the auditor shall make inquiries of

management about changes in circumstances that may give rise to new, or the need to

revise existing, accounting estimates. (Ref: Para. A16-A21)

(c) How management makes the accounting estimates, and an understanding of the data on

which they are based, including: (Ref: Para. A22-A23)

(i) The method, including where applicable the model, used in making the accounting

estimate; (Ref: Para. A24-A26)

(ii) Relevant controls; (Ref: Para. A27-A28)

(iii) Whether management has used a management expert; (Ref: Para. A29-A30)

(iv) The assumptions underlying the accounting estimates; (Ref: Para. A31-A36)

(v) Whether there has been or ought to have been a change from the prior period in the

methods for making the accounting estimates, and if so, why; and (Ref: Para. A37)

(vi) Whether and, if so, how management has assessed the effect of estimation

uncertainty. (Ref: Para. A38)

540.9 The auditor shall review the outcome of accounting estimates included in the prior period

financial statements, or, where applicable, their subsequent re-estimation for the purpose of

the current period. The nature and extent of the auditor’s review takes account of the nature

of the accounting estimates, and whether the information obtained from the review would be

relevant to identifying and assessing risks of material misstatement of accounting estimates

made in the current period financial statements. However, the review is not intended to

call into question the judgments made in the prior periods that were based on information

available at the time. (Ref: Para. A39-A44)

540.10 In identifying and assessing the risks of material misstatement, as required by ISA 315, the

auditor shall evaluate the degree of estimation uncertainty associated with an accounting

estimate. (Ref: Para. A45-A46)

540.11 The auditor shall determine whether, in the auditor’s judgment, any of those accounting

estimates that have been identified as having high estimation uncertainty give rise to

significant risks. (Ref: Para. A47-A51)

For smaller entities, the amount of work involved in preparing estimates will be less complex, as their business

activities are often limited and transactions are less complex. Often a single person, such as the owner-

manager, will identify the need for accounting estimates, and the auditor may focus the inquiries accordingly.

However, smaller entities will also be less likely to have a management expert available who would use his

or her experience and competence to make the required point estimates. In these cases, the risk of material

misstatement might actually increase, unless of course such an expert is hired.

139