Page 26 - Internal Auditing Standards

P. 26

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

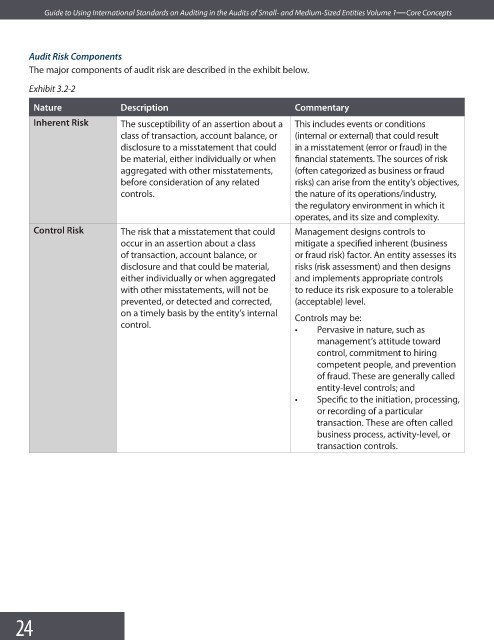

Audit Risk Components

The major components of audit risk are described in the exhibit below.

Exhibit 3.2-2

Nature Description Commentary

Inherent Risk The susceptibility of an assertion about a This includes events or conditions

class of transaction, account balance, or (internal or external) that could result

disclosure to a misstatement that could in a misstatement (error or fraud) in the

be material, either individually or when financial statements. The sources of risk

aggregated with other misstatements, (often categorized as business or fraud

before consideration of any related risks) can arise from the entity’s objectives,

controls. the nature of its operations/industry,

the regulatory environment in which it

operates, and its size and complexity.

Control Risk The risk that a misstatement that could Management designs controls to

occur in an assertion about a class mitigate a specified inherent (business

of transaction, account balance, or or fraud risk) factor. An entity assesses its

disclosure and that could be material, risks (risk assessment) and then designs

either individually or when aggregated and implements appropriate controls

with other misstatements, will not be to reduce its risk exposure to a tolerable

prevented, or detected and corrected, (acceptable) level.

on a timely basis by the entity’s internal

Controls may be:

control.

• Pervasive in nature, such as

management’s attitude toward

control, commitment to hiring

competent people, and prevention

of fraud. These are generally called

entity-level controls; and

• Specific to the initiation, processing,

or recording of a particular

transaction. These are often called

business process, activity-level, or

transaction controls.

24