Page 24 - Internal Auditing Standards

P. 24

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

Reasonable Assurance

ISAs require the auditor to obtain reasonable assurance about whether the financial statements as a whole

are free from material misstatement, whether due to fraud or error.

Reasonable assurance is a high but not absolute level of assurance. It is obtained when the auditor has

obtained sufficient appropriate audit evidence to reduce audit risk (that is, the risk that the auditor expresses

an inappropriate opinion when the financial statements are materially misstated) to an acceptably low level.

The auditor cannot provide absolute assurance due to the inherent limitations in the work carried out. This

results from the majority of audit evidence (on which the auditor draws conclusions and bases the auditor’s

opinion) being persuasive rather than conclusive.

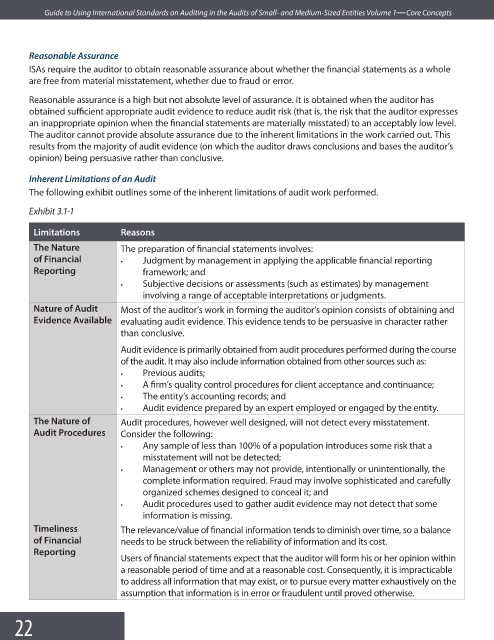

Inherent Limitations of an Audit

The following exhibit outlines some of the inherent limitations of audit work performed.

Exhibit 3.1-1

Limitations Reasons

The Nature The preparation of financial statements involves:

of Financial • Judgment by management in applying the applicable fi nancial reporting

Reporting framework; and

• Subjective decisions or assessments (such as estimates) by management

involving a range of acceptable interpretations or judgments.

Nature of Audit Most of the auditor’s work in forming the auditor’s opinion consists of obtaining and

Evidence Available evaluating audit evidence. This evidence tends to be persuasive in character rather

than conclusive.

Audit evidence is primarily obtained from audit procedures performed during the course

of the audit. It may also include information obtained from other sources such as:

• Previous audits;

• A firm’s quality control procedures for client acceptance and continuance;

• The entity’s accounting records; and

• Audit evidence prepared by an expert employed or engaged by the entity.

The Nature of Audit procedures, however well designed, will not detect every misstatement.

Audit Procedures Consider the following:

• Any sample of less than 100% of a population introduces some risk that a

misstatement will not be detected;

• Management or others may not provide, intentionally or unintentionally, the

complete information required. Fraud may involve sophisticated and carefully

organized schemes designed to conceal it; and

• Audit procedures used to gather audit evidence may not detect that some

information is missing.

Timeliness The relevance/value of financial information tends to diminish over time, so a balance

of Financial needs to be struck between the reliability of information and its cost.

Reporting

Users of financial statements expect that the auditor will form his or her opinion within

a reasonable period of time and at a reasonable cost. Consequently, it is impracticable

to address all information that may exist, or to pursue every matter exhaustively on the

assumption that information is in error or fraudulent until proved otherwise.

22