Page 27 - Internal Auditing Standards

P. 27

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

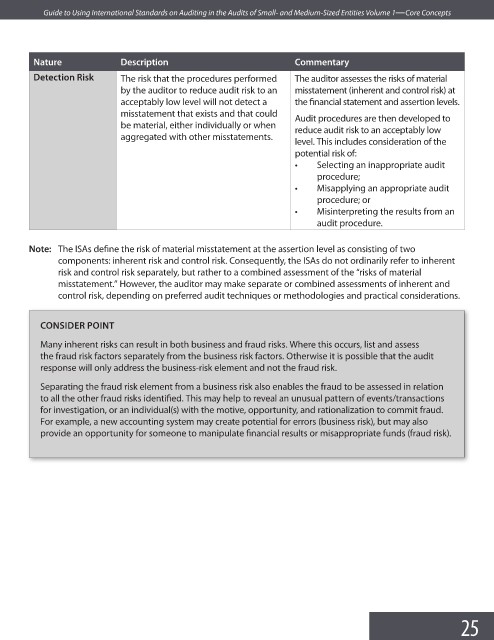

Nature Description Commentary

Detection Risk The risk that the procedures performed The auditor assesses the risks of material

by the auditor to reduce audit risk to an misstatement (inherent and control risk) at

acceptably low level will not detect a the financial statement and assertion levels.

misstatement that exists and that could

Audit procedures are then developed to

be material, either individually or when

reduce audit risk to an acceptably low

aggregated with other misstatements.

level. This includes consideration of the

potential risk of:

• Selecting an inappropriate audit

procedure;

• Misapplying an appropriate audit

procedure; or

• Misinterpreting the results from an

audit procedure.

Note: The ISAs define the risk of material misstatement at the assertion level as consisting of two

components: inherent risk and control risk. Consequently, the ISAs do not ordinarily refer to inherent

risk and control risk separately, but rather to a combined assessment of the “risks of material

misstatement.” However, the auditor may make separate or combined assessments of inherent and

control risk, depending on preferred audit techniques or methodologies and practical considerations.

CONSIDER POINT

Many inherent risks can result in both business and fraud risks. Where this occurs, list and assess

the fraud risk factors separately from the business risk factors. Otherwise it is possible that the audit

response will only address the business-risk element and not the fraud risk.

Separating the fraud risk element from a business risk also enables the fraud to be assessed in relation

to all the other fraud risks identified. This may help to reveal an unusual pattern of events/transactions

for investigation, or an individual(s) with the motive, opportunity, and rationalization to commit fraud.

For example, a new accounting system may create potential for errors (business risk), but may also

provide an opportunity for someone to manipulate financial results or misappropriate funds (fraud risk).

25