Page 29 - Internal Auditing Standards

P. 29

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

3.3 How to Perform a Risk-Based Audit

Paragraph # Relevant Extracts from ISAs

200.15 The auditor shall plan and perform an audit with professional skepticism recognizing that

circumstances may exist that cause the financial statements to be materially misstated. (Ref:

Para. A18-A22)

200.16 The auditor shall exercise professional judgment in planning and performing an audit of

financial statements. (Ref: Para. A23-A27)

200.17 To obtain reasonable assurance, the auditor shall obtain sufficient appropriate audit evidence

to reduce audit risk to an acceptably low level and thereby enable the auditor to draw

reasonable conclusions on which to base the auditor’s opinion. (Ref: Para. A28-A52)

200.21 To achieve the overall objectives of the auditor, the auditor shall use the objectives stated in

relevant ISAs in planning and performing the audit, having regard to the interrelationships

among the ISAs, to: (Ref: Para. A67-A69)

(a) Determine whether any audit procedures in addition to those required by the ISAs are

necessary in pursuance of the objectives stated in the ISAs; and (Ref: Para. A70)

(b) Evaluate whether sufficient appropriate audit evidence has been obtained. (Ref: Para. A71)

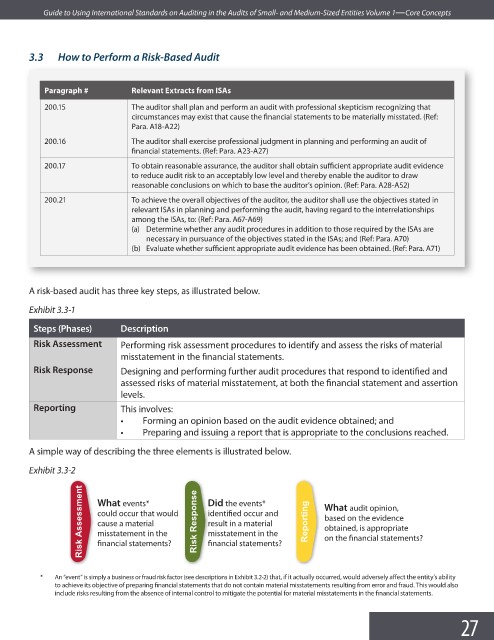

A risk-based audit has three key steps, as illustrated below.

Exhibit 3.3-1

Steps (Phases) Description

Risk Assessment Performing risk assessment procedures to identify and assess the risks of material

misstatement in the fi nancial statements.

Risk Response Designing and performing further audit procedures that respond to identifi ed and

assessed risks of material misstatement, at both the financial statement and assertion

levels.

Reporting This involves:

• Forming an opinion based on the audit evidence obtained; and

• Preparing and issuing a report that is appropriate to the conclusions reached.

A simple way of describing the three elements is illustrated below.

Exhibit 3.3-2

Risk Assessment What events* Risk Response Did the events* Reporting What audit opinion,

identified occur and

could occur that would

based on the evidence

cause a material

result in a material

obtained, is appropriate

misstatement in the

misstatement in the

on the financial statements?

financial statements?

financial statements?

* An “event” is simply a business or fraud risk factor (see descriptions in Exhibit 3.2-2) that, if it actually occurred, would adversely affect the entity’s ability

to achieve its objective of preparing financial statements that do not contain material misstatements resulting from error and fraud. This would also

include risks resulting from the absence of internal control to mitigate the potential for material misstatements in the fi nancial statements.

27