Page 35 - Internal Auditing Standards

P. 35

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

A team debriefing meeting (towards or at the end of the fieldwork) is not a specific requirement of the ISAs,

but can be useful for staff to discuss the audit fi ndings, identify any indications of fraud, and determine the

need (if any) to perform any further audit procedures.

When all procedures have been performed and conclusions reached:

• Audit findings should be reported to management and those charged with governance; and

• An audit opinion should be formed and a decision made on the appropriate wording for the auditor’s report.

3.4 Documentation

Sufficient audit documentation is required to enable an experienced auditor, having no previous connection

with the audit, to understand:

• The nature, timing, and extent of the audit procedures performed;

• The results of performing those procedures and the audit evidence obtained; and

• Significant matters arising during the audit, the conclusions reached thereon; and signifi cant

professional judgments made in reaching those conclusions.

Audit documentation for a smaller entity is generally less extensive than that for the audit of a larger entity.

For example, various aspects of the audit could be recorded together in a single document, with cross-

references to supporting working papers, as appropriate.

It is not necessary for the auditor to document:

• Every minor matter considered, or every professional judgment made, in an audit; and

• Compliance with matters for which compliance is demonstrated by documents included within the

audit file. For example, an audit plan on file demonstrates that the audit was planned, and a signed

engagement letter demonstrates that the auditor has agreed to the terms of the audit engagement.

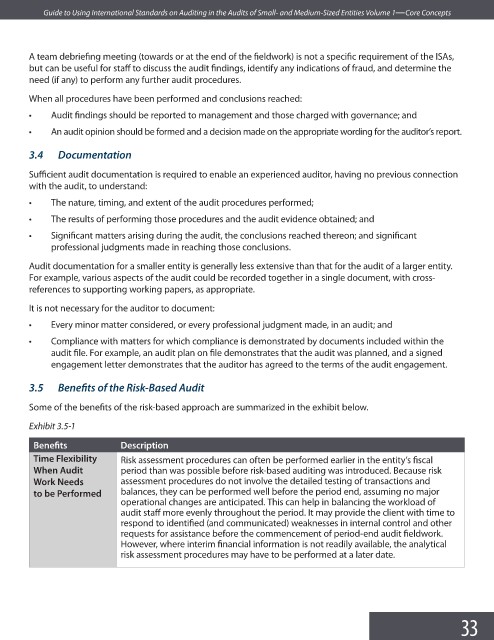

3.5 Benefits of the Risk-Based Audit

Some of the benefits of the risk-based approach are summarized in the exhibit below.

Exhibit 3.5-1

Benefi ts Description

Time Flexibility Risk assessment procedures can often be performed earlier in the entity’s fi scal

When Audit period than was possible before risk-based auditing was introduced. Because risk

Work Needs assessment procedures do not involve the detailed testing of transactions and

to be Performed balances, they can be performed well before the period end, assuming no major

operational changes are anticipated. This can help in balancing the workload of

audit staff more evenly throughout the period. It may provide the client with time to

respond to identified (and communicated) weaknesses in internal control and other

requests for assistance before the commencement of period-end audit fi eldwork.

However, where interim financial information is not readily available, the analytical

risk assessment procedures may have to be performed at a later date.

33