Page 36 - Internal Auditing Standards

P. 36

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

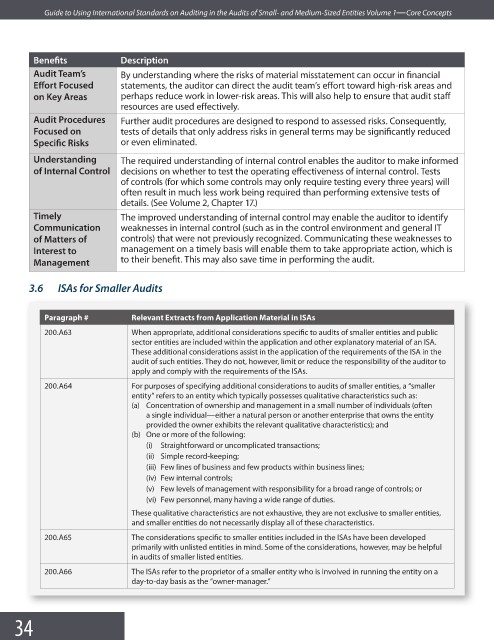

Benefi ts Description

Audit Team’s By understanding where the risks of material misstatement can occur in fi nancial

Eff ort Focused statements, the auditor can direct the audit team’s effort toward high-risk areas and

on Key Areas perhaps reduce work in lower-risk areas. This will also help to ensure that audit staff

resources are used eff ectively.

Audit Procedures Further audit procedures are designed to respond to assessed risks. Consequently,

Focused on tests of details that only address risks in general terms may be signifi cantly reduced

Specifi c Risks or even eliminated.

Understanding The required understanding of internal control enables the auditor to make informed

of Internal Control decisions on whether to test the operating effectiveness of internal control. Tests

of controls (for which some controls may only require testing every three years) will

often result in much less work being required than performing extensive tests of

details. (See Volume 2, Chapter 17.)

Timely The improved understanding of internal control may enable the auditor to identify

Communication weaknesses in internal control (such as in the control environment and general IT

of Matters of controls) that were not previously recognized. Communicating these weaknesses to

Interest to management on a timely basis will enable them to take appropriate action, which is

Management to their benefit. This may also save time in performing the audit.

3.6 ISAs for Smaller Audits

Paragraph # Relevant Extracts from Application Material in ISAs

200.A63 When appropriate, additional considerations specific to audits of smaller entities and public

sector entities are included within the application and other explanatory material of an ISA.

These additional considerations assist in the application of the requirements of the ISA in the

audit of such entities. They do not, however, limit or reduce the responsibility of the auditor to

apply and comply with the requirements of the ISAs.

200.A64 For purposes of specifying additional considerations to audits of smaller entities, a “smaller

entity” refers to an entity which typically possesses qualitative characteristics such as:

(a) Concentration of ownership and management in a small number of individuals (often

a single individual—either a natural person or another enterprise that owns the entity

provided the owner exhibits the relevant qualitative characteristics); and

(b) One or more of the following:

(i) Straightforward or uncomplicated transactions;

(ii) Simple record-keeping;

(iii) Few lines of business and few products within business lines;

(iv) Few internal controls;

(v) Few levels of management with responsibility for a broad range of controls; or

(vi) Few personnel, many having a wide range of duties.

These qualitative characteristics are not exhaustive, they are not exclusive to smaller entities,

and smaller entities do not necessarily display all of these characteristics.

200.A65 The considerations specific to smaller entities included in the ISAs have been developed

primarily with unlisted entities in mind. Some of the considerations, however, may be helpful

in audits of smaller listed entities.

200.A66 The ISAs refer to the proprietor of a smaller entity who is involved in running the entity on a

day-to-day basis as the “owner-manager.”

34