Page 422 - Large Business IRS Training Guides

P. 422

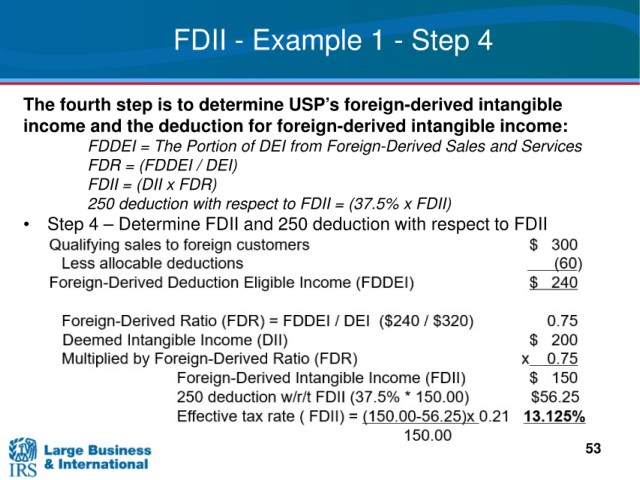

FDII - Example 1 - Step 4

fourth step is to determine USP’s foreign-derived intangible

The

income and the deduction for foreign-derived intangible

income:

FDDEI =

The Portion of DEI from Foreign-Derived Sales and Services

FDR =

(FDDEI / DEI)

FDII =

(DII x FDR)

250 deduction with respect

to FDII = (37.5% x FDII)

• Step 4 – Determine FDII

and 250 deduction with respect to FDII

53