Page 423 - Large Business IRS Training Guides

P. 423

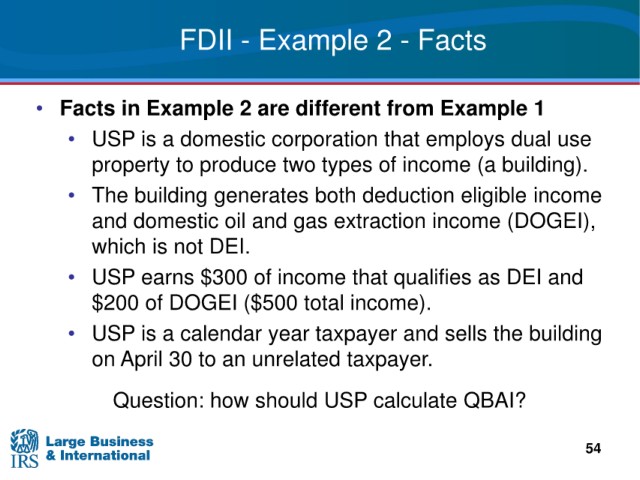

FDII - Example 2 - Facts

• Facts in Example 2 are different from Example 1

a domestic corporation that employs dual use

• USP is

to produce two types of income (a building).

property

both deduction eligible income

• The building generates

oil and gas extraction income (DOGEI),

and domestic

not DEI.

which is

• USP

earns $300 of income that qualifies as DEI and

$200 of DOGEI

($500 total income).

• USP is

a calendar year taxpayer and sells the building

on April

30 to an unrelated taxpayer.

Question:

how should USP calculate QBAI?

54