Page 424 - Large Business IRS Training Guides

P. 424

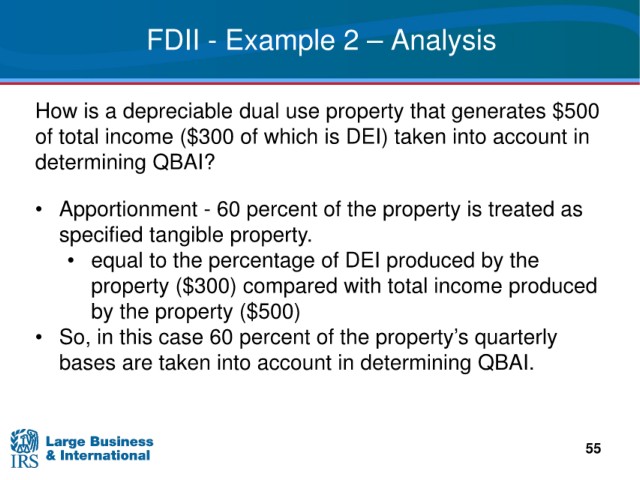

FDII - Example 2 – Analysis 1

is a depreciable dual use property that generates $500

How

of total income ($300 of which is

DEI) taken into account in

determining QBAI?

- 60 percent of the property is treated as

• Apportionment

specified tangible property.

to the percentage of DEI produced by the

• equal

property ($300) compared with total income produced

by the property ($500)

• So,

in this case 60 percent of the property’s quarterly

bases

are taken into account in determining QBAI.

55