Page 426 - Large Business IRS Training Guides

P. 426

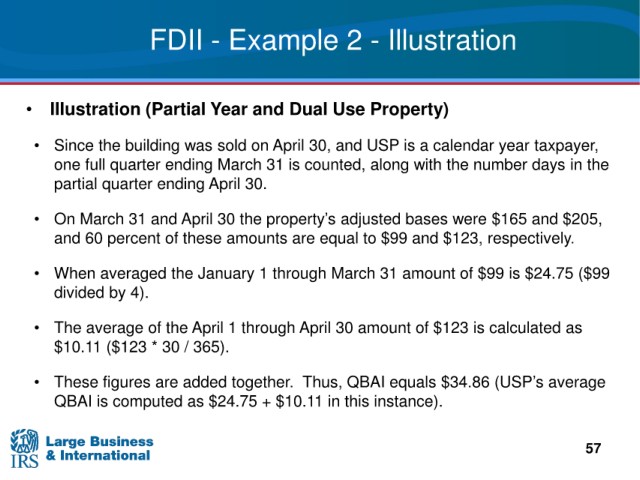

FDII - Example 2 - Illustration

Year and Dual Use Property)

• Illustration (Partial

• Since the building was

sold on April 30, and USP is a calendar year taxpayer,

quarter ending March 31 is counted, along with the number days in the

one full

partial quarter ending April 30.

• On March 31 and April 30 the property’s

adjusted bases were $165 and $205,

these amounts are equal to $99 and $123, respectively.

and 60 percent of

1 through March 31 amount of $99 is $24.75 ($99

• When averaged the January

4).

divided by

• The average of the April 1 through April

30 amount of $123 is calculated as

$10.11 ($123 * 30 / 365).

• These figures Thus, QBAI equals $34.86 (USP’s average

are added together.

QBAI

is computed as $24.75 + $10.11 in this instance).

57