Page 427 - Large Business IRS Training Guides

P. 427

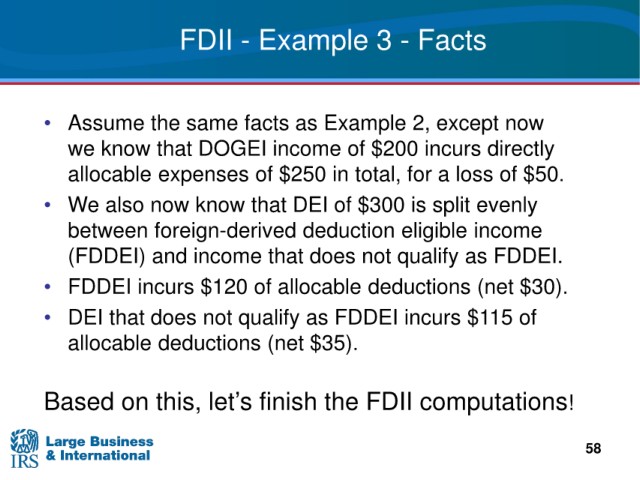

FDII - Example 3 - Facts

as Example 2, except now

• Assume the same facts

DOGEI income of $200 incurs directly

we know that

of $250 in total, for a loss of $50.

allocable expenses

DEI of $300 is split evenly

• We also now know that

between foreign-derived deduction eligible income

does not qualify as FDDEI.

(FDDEI) and income that

• FDDEI

incurs $120 of allocable deductions (net $30).

that does not qualify as FDDEI incurs $115 of

• DEI

allocable deductions

(net $35).

Based on this,

let’s finish the FDII computations!

58