Page 106 - TaxAdviser_Jan_Apr23_Neat

P. 106

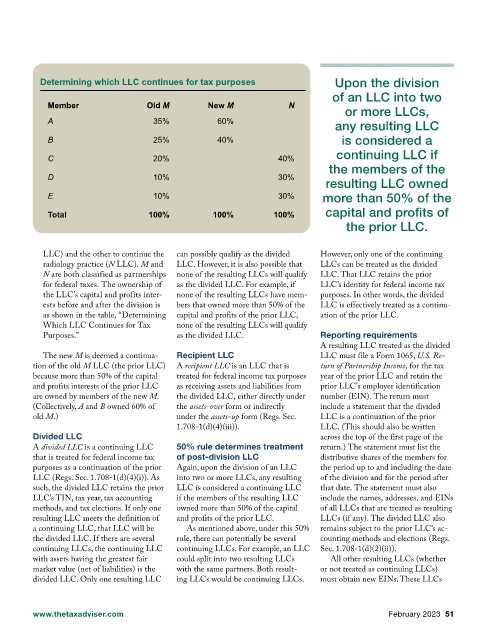

Determining which LLC continues for tax purposes Upon the division

of an LLC into two

Member Old M New M N

or more LLCs,

A 35% 60%

any resulting LLC

B 25% 40% is considered a

C 20% 40% continuing LLC if

the members of the

D 10% 30%

resulting LLC owned

E 10% 30% more than 50% of the

Total 100% 100% 100% capital and profits of

the prior LLC.

LLC) and the other to continue the can possibly qualify as the divided However, only one of the continuing

radiology practice (N LLC). M and LLC. However, it is also possible that LLCs can be treated as the divided

N are both classified as partnerships none of the resulting LLCs will qualify LLC. That LLC retains the prior

for federal taxes. The ownership of as the divided LLC. For example, if LLC’s identity for federal income tax

the LLC’s capital and profits inter- none of the resulting LLCs have mem- purposes. In other words, the divided

ests before and after the division is bers that owned more than 50% of the LLC is effectively treated as a continu-

as shown in the table, “Determining capital and profits of the prior LLC, ation of the prior LLC.

Which LLC Continues for Tax none of the resulting LLCs will qualify

Purposes.” as the divided LLC. Reporting requirements

A resulting LLC treated as the divided

The new M is deemed a continua- Recipient LLC LLC must file a Form 1065, U.S. Re-

tion of the old M LLC (the prior LLC) A recipient LLC is an LLC that is turn of Partnership Income, for the tax

because more than 50% of the capital treated for federal income tax purposes year of the prior LLC and retain the

and profits interests of the prior LLC as receiving assets and liabilities from prior LLC’s employer identification

are owned by members of the new M. the divided LLC, either directly under number (EIN). The return must

(Collectively, A and B owned 60% of the assets-over form or indirectly include a statement that the divided

old M.) under the assets-up form (Regs. Sec. LLC is a continuation of the prior

1.708-1(d)(4)(iii)). LLC. (This should also be written

Divided LLC across the top of the first page of the

A divided LLC is a continuing LLC 50% rule determines treatment return.) The statement must list the

that is treated for federal income tax of post-division LLC distributive shares of the members for

purposes as a continuation of the prior Again, upon the division of an LLC the period up to and including the date

LLC (Regs. Sec. 1.708-1(d)(4)(i)). As into two or more LLCs, any resulting of the division and for the period after

such, the divided LLC retains the prior LLC is considered a continuing LLC that date. The statement must also

LLC’s TIN, tax year, tax accounting if the members of the resulting LLC include the names, addresses, and EINs

methods, and tax elections. If only one owned more than 50% of the capital of all LLCs that are treated as resulting

resulting LLC meets the definition of and profits of the prior LLC. LLCs (if any). The divided LLC also

a continuing LLC, that LLC will be As mentioned above, under this 50% remains subject to the prior LLC’s ac-

the divided LLC. If there are several rule, there can potentially be several counting methods and elections (Regs.

continuing LLCs, the continuing LLC continuing LLCs. For example, an LLC Sec. 1.708-1(d)(2)(ii)).

with assets having the greatest fair could split into two resulting LLCs All other resulting LLCs (whether

market value (net of liabilities) is the with the same partners. Both result- or not treated as continuing LLCs)

divided LLC. Only one resulting LLC ing LLCs would be continuing LLCs. must obtain new EINs. These LLCs

www.thetaxadviser.com February 2023 51