Page 186 - TaxAdviser_Jan_Apr23_Neat

P. 186

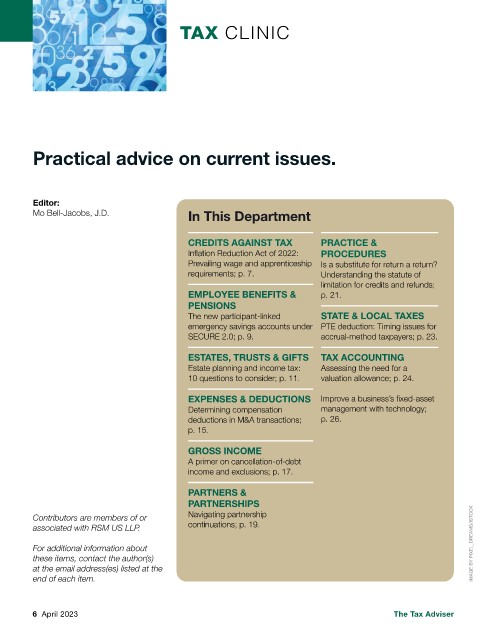

TAX CLINIC

Practical advice on current issues.

Editor:

Mo Bell-Jacobs, J.D. In This Department

CREDITS AGAINST TAX PRACTICE &

Inflation Reduction Act of 2022: PROCEDURES

Prevailing wage and apprenticeship Is a substitute for return a return?

requirements; p. 7. Understanding the statute of

limitation for credits and refunds;

EMPLOYEE BENEFITS & p. 21.

PENSIONS

The new participant-linked STATE & LOCAL TAXES

emergency savings accounts under PTE deduction: Timing issues for

SECURE 2.0; p. 9. accrual-method taxpayers; p. 23.

ESTATES, TRUSTS & GIFTS TAX ACCOUNTING

Estate planning and income tax: Assessing the need for a

10 questions to consider; p. 11. valuation allowance; p. 24.

EXPENSES & DEDUCTIONS Improve a business’s fixed-asset

Determining compensation management with technology;

deductions in M&A transactions; p. 26.

p. 15.

GROSS INCOME

A primer on cancellation-of-debt

income and exclusions; p. 17.

PARTNERS &

PARTNERSHIPS

Contributors are members of or Navigating partnership

associated with RSM US LLP. continuations; p. 19.

For additional information about IMAGE BY PIXEL_DREAMS/ISTOCK

these items, contact the author(s)

at the email address(es) listed at the

end of each item.

6 April 2023 The Tax Adviser