Page 48 - TaxAdviser_Jan_Apr23_Neat

P. 48

CASE STUDY

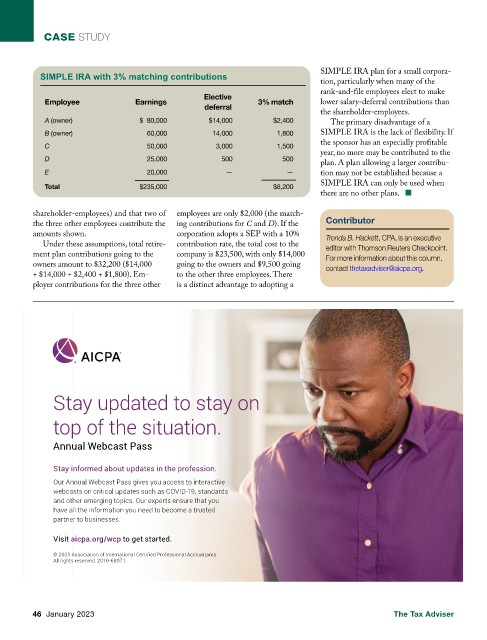

SIMPLE IRA with 3% matching contributions SIMPLE IRA plan for a small corpora-

tion, particularly when many of the

rank-and-file employees elect to make

Elective

Employee Earnings 3% match lower salary-deferral contributions than

deferral

the shareholder-employees.

A (owner) $ 80,000 $14,000 $2,400 The primary disadvantage of a

B (owner) 60,000 14,000 1,800 SIMPLE IRA is the lack of flexibility. If

C 50,000 3,000 1,500 the sponsor has an especially profitable

year, no more may be contributed to the

D 25,000 500 500

plan. A plan allowing a larger contribu-

E 20,000 — — tion may not be established because a

Total $235,000 $6,200 SIMPLE IRA can only be used when

there are no other plans. ■

shareholder-employees) and that two of employees are only $2,000 (the match-

the three other employees contribute the ing contributions for C and D). If the Contributor

amounts shown. corporation adopts a SEP with a 10%

Trenda B. Hackett, CPA, is an executive

Under these assumptions, total retire- contribution rate, the total cost to the

editor with Thomson Reuters Checkpoint.

ment plan contributions going to the company is $23,500, with only $14,000

For more information about this column,

owners amount to $32,200 ($14,000 going to the owners and $9,500 going

contact thetaxadviser@aicpa.org.

+ $14,000 + $2,400 + $1,800). Em- to the other three employees. There

ployer contributions for the three other is a distinct advantage to adopting a

Stay updated to stay on

top of the situation.

Annual Webcast Pass

Stay informed about updates in the profession.

Our Annual Webcast Pass gives you access to interactive

webcasts on critical updates such as COVID-19, standards

and other emerging topics. Our experts ensure that you

have all the information you need to become a trusted

partner to businesses.

Visit aicpa.org/wcp to get started.

© 2021 Association of International Certified Professional Accountants.

All rights reserved. 2010-68971

46 January 2023 The Tax Adviser