Page 282 - International Taxation IRS Training Guides

P. 282

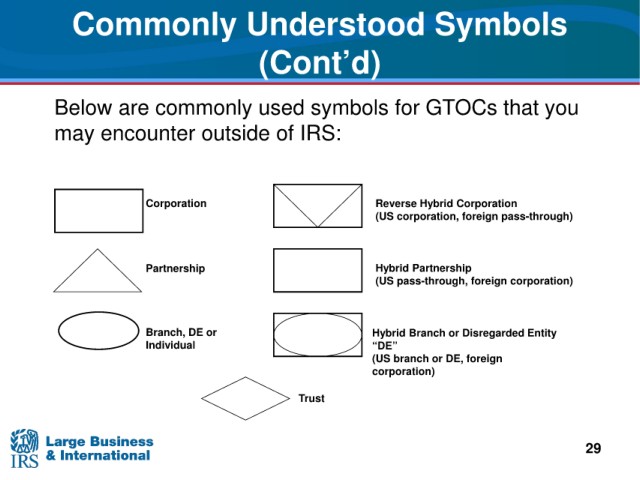

Commonly Understood Symbols

(Cont’d)

are commonly used symbols for GTOCs that you

Below

outside of IRS:

may encounter

Corporation Reverse Hybrid Corporation

(US corporation, foreign pass-through)

Partnership Hybrid Partnership

(US pass-through, foreign corporation)

Branch, DE or Hybrid Branch or Disregarded Entity

Individual “DE”

(US branch or DE, foreign

corporation)

Trust

29