Page 284 - International Taxation IRS Training Guides

P. 284

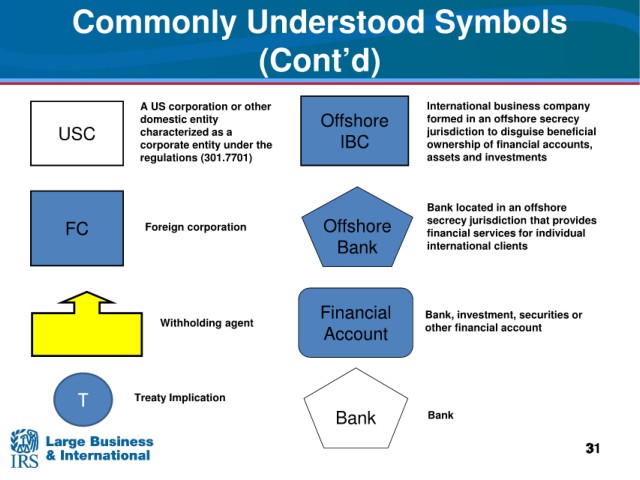

Commonly Understood Symbols

(Cont’d)

A US corporation or other International business company

domestic entity Offshore formed in an offshore secrecy

USC

characterized as a jurisdiction to disguise beneficial

corporate entity under the IBC ownership of financial accounts,

regulations (301.7701) assets and investments

Bank located in an offshore

FC

Foreign corporation Offshore secrecy jurisdiction that provides

financial

services for individual

Bank international clients

Financial Bank, investment, securities or

Withholding agent other financial account

Account

T Treaty Implication

Bank Bank

31

31