Page 287 - International Taxation IRS Training Guides

P. 287

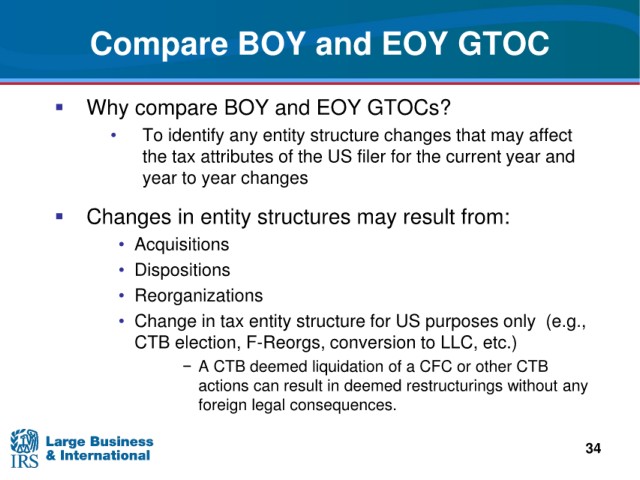

Compare

BOY and EOY GTOC

Why compare BOY and EOY GTOCs?

any entity structure changes that may affect

• To identify

the tax

attributes of the US filer for the current year and

year

to year changes

in entity structures may result from:

Changes

• Acquisitions

• Dispositions

• Reorganizations

entity structure for US purposes only

• Change in tax (e.g.,

CTB

election, F-Reorgs, conversion to LLC, etc.)

deemed liquidation of a CFC or other CTB

− A CTB

in deemed restructurings without any

actions can result

foreign legal consequences.

34