Page 286 - International Taxation IRS Training Guides

P. 286

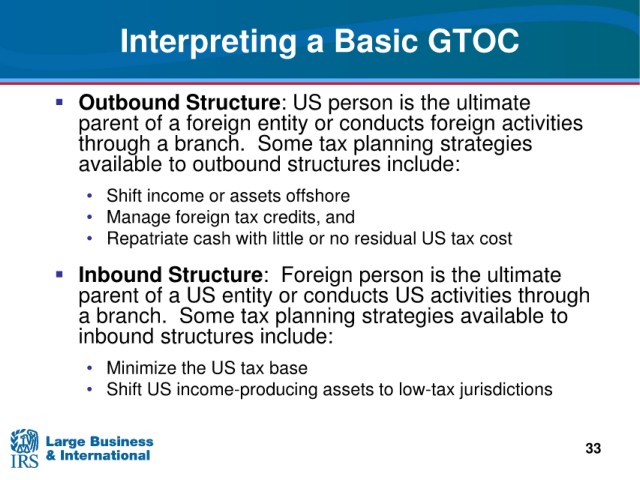

Interpreting a

Basic GTOC

Outbound Structure:

US person is the ultimate

parent

of a foreign entity or conducts foreign activities

Some tax planning strategies

through a branch.

available to outbound structures include:

income or assets offshore

• Shift

credits, and

• Manage foreign tax

• Repatriate cash with little or

no residual US tax cost

Inbound Structure: Foreign person is the ultimate

parent

of a US entity or conducts US activities through

Some tax planning strategies available to

a branch.

inbound structures include:

• Minimize the US

tax base

• Shift

US income-producing assets to low-tax jurisdictions

33