Page 283 - International Taxation IRS Training Guides

P. 283

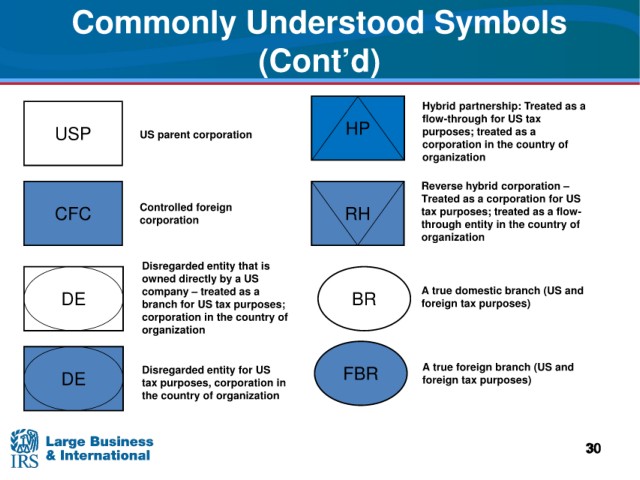

Commonly Understood Symbols

(Cont’d)

Hybrid partnership: Treated as a

HP flow-through for US tax

USP

US parent corporation purposes; treated as a

corporation in the country of

organization

Reverse hybrid corporation –

Treated as a corporation for US

Controlled foreign

CFC

corporation RH tax purposes; treated as a flow-

through entity in the

country of

organization

Disregarded entity that is

owned directly by a US

A true domestic branch (US and

DE company – treated as a BR foreign tax purposes)

branch for

US tax purposes;

corporation in the country of

organization

A true foreign branch (US and

DE Disregarded entity for US FBR foreign tax purposes)

tax purposes, corporation in

the country of organization

30

30