Page 138 - IRS Plan

P. 138

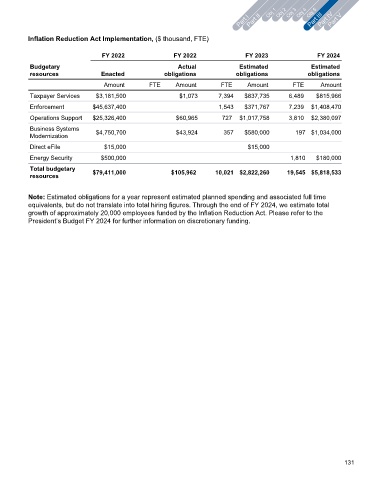

Inflation Reduction Act Implementation, ($ thousand, FTE)

FY 2022 FY 2022 FY 2023 FY 2024

Budgetary Actual Estimated Estimated

resources Enacted obligations obligations obligations

Amount FTE Amount FTE Amount FTE Amount

Taxpayer Services $3,181,500 $1,073 7,394 $837,735 6,489 $815,966

Enforcement $45,637,400 1,543 $371,767 7,239 $1,408,470

Operations Support $25,326,400 $60,965 727 $1,017,758 3,810 $2,380,097

Business Systems $4,750,700 $43,924 357 $580,000 197 $1,034,000

Modernization

Direct eFile $15,000 $15,000

Energy Security $500,000 1,810 $180,000

Total budgetary $79,411,000 $105,962 10,021 $2,822,260 19,545 $5,818,533

resources

Note: Estimated obligations for a year represent estimated planned spending and associated full time

equivalents, but do not translate into total hiring figures. Through the end of FY 2024, we estimate total

growth of approximately 20,000 employees funded by the Inflation Reduction Act. Please refer to the

President’s Budget FY 2024 for further information on discretionary funding.

131