Page 153 - Bankruptcy Volume 1

P. 153

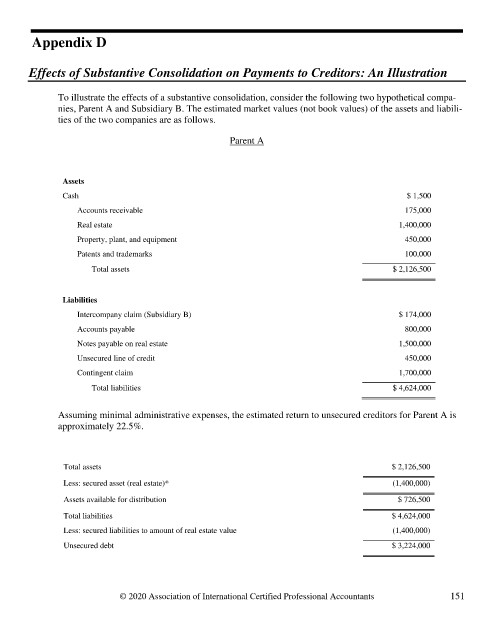

Appendix D

Effects of Substantive Consolidation on Payments to Creditors: An Illustration

To illustrate the effects of a substantive consolidation, consider the following two hypothetical compa-

nies, Parent A and Subsidiary B. The estimated market values (not book values) of the assets and liabili-

ties of the two companies are as follows.

Parent A

Assets

Cash $ 1,500

Accounts receivable 175,000

Real estate 1,400,000

Property, plant, and equipment 450,000

Patents and trademarks 100,000

Total assets $ 2,126,500

Liabilities

Intercompany claim (Subsidiary B) $ 174,000

Accounts payable 800,000

Notes payable on real estate 1,500,000

Unsecured line of credit 450,000

Contingent claim 1,700,000

Total liabilities $ 4,624,000

Assuming minimal administrative expenses, the estimated return to unsecured creditors for Parent A is

approximately 22.5%.

Total assets $ 2,126,500

Less: secured asset (real estate)* (1,400,000)

Assets available for distribution $ 726,500

Total liabilities $ 4,624,000

Less: secured liabilities to amount of real estate value (1,400,000)

Unsecured debt $ 3,224,000

© 2020 Association of International Certified Professional Accountants 151