Page 155 - Bankruptcy Volume 1

P. 155

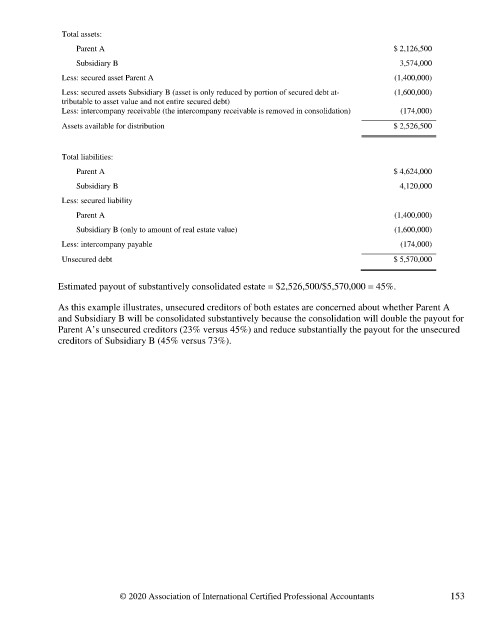

Total assets:

Parent A $ 2,126,500

Subsidiary B 3,574,000

Less: secured asset Parent A (1,400,000)

Less: secured assets Subsidiary B (asset is only reduced by portion of secured debt at- (1,600,000)

tributable to asset value and not entire secured debt)

Less: intercompany receivable (the intercompany receivable is removed in consolidation) (174,000)

Assets available for distribution $ 2,526,500

Total liabilities:

Parent A $ 4,624,000

Subsidiary B 4,120,000

Less: secured liability

Parent A (1,400,000)

Subsidiary B (only to amount of real estate value) (1,600,000)

Less: intercompany payable (174,000)

Unsecured debt $ 5,570,000

Estimated payout of substantively consolidated estate = $2,526,500/$5,570,000 = 45%.

As this example illustrates, unsecured creditors of both estates are concerned about whether Parent A

and Subsidiary B will be consolidated substantively because the consolidation will double the payout for

Parent A’s unsecured creditors (23% versus 45%) and reduce substantially the payout for the unsecured

creditors of Subsidiary B (45% versus 73%).

© 2020 Association of International Certified Professional Accountants 153