Page 157 - Bankruptcy Volume 1

P. 157

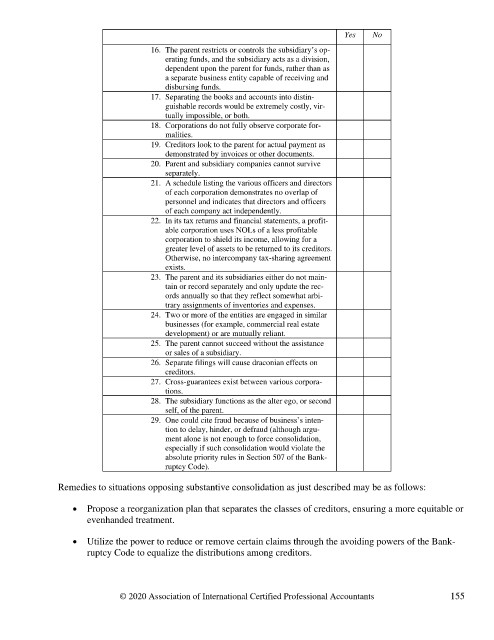

Yes No

16. The parent restricts or controls the subsidiary’s op-

erating funds, and the subsidiary acts as a division,

dependent upon the parent for funds, rather than as

a separate business entity capable of receiving and

disbursing funds.

17. Separating the books and accounts into distin-

guishable records would be extremely costly, vir-

tually impossible, or both.

18. Corporations do not fully observe corporate for-

malities.

19. Creditors look to the parent for actual payment as

demonstrated by invoices or other documents.

20. Parent and subsidiary companies cannot survive

separately.

21. A schedule listing the various officers and directors

of each corporation demonstrates no overlap of

personnel and indicates that directors and officers

of each company act independently.

22. In its tax returns and financial statements, a profit-

able corporation uses NOLs of a less profitable

corporation to shield its income, allowing for a

greater level of assets to be returned to its creditors.

Otherwise, no intercompany tax-sharing agreement

exists.

23. The parent and its subsidiaries either do not main-

tain or record separately and only update the rec-

ords annually so that they reflect somewhat arbi-

trary assignments of inventories and expenses.

24. Two or more of the entities are engaged in similar

businesses (for example, commercial real estate

development) or are mutually reliant.

25. The parent cannot succeed without the assistance

or sales of a subsidiary.

26. Separate filings will cause draconian effects on

creditors.

27. Cross-guarantees exist between various corpora-

tions.

28. The subsidiary functions as the alter ego, or second

self, of the parent.

29. One could cite fraud because of business’s inten-

tion to delay, hinder, or defraud (although argu-

ment alone is not enough to force consolidation,

especially if such consolidation would violate the

absolute priority rules in Section 507 of the Bank-

ruptcy Code).

Remedies to situations opposing substantive consolidation as just described may be as follows:

Propose a reorganization plan that separates the classes of creditors, ensuring a more equitable or

evenhanded treatment.

Utilize the power to reduce or remove certain claims through the avoiding powers of the Bank-

ruptcy Code to equalize the distributions among creditors.

© 2020 Association of International Certified Professional Accountants 155