Page 154 - Bankruptcy Volume 1

P. 154

Estimated payout = $726,500/$3,224,000 = 22.5%

* Only value of real estate deducted not total debt. $100,000 ($1.5 million less $1.4 mil-

lion) will be treated as unsecured debt.

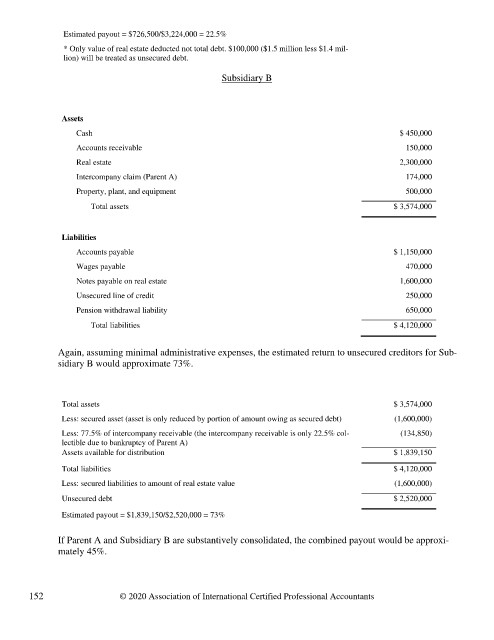

Subsidiary B

Assets

Cash $ 450,000

Accounts receivable 150,000

Real estate 2,300,000

Intercompany claim (Parent A) 174,000

Property, plant, and equipment 500,000

Total assets $ 3,574,000

Liabilities

Accounts payable $ 1,150,000

Wages payable 470,000

Notes payable on real estate 1,600,000

Unsecured line of credit 250,000

Pension withdrawal liability 650,000

Total liabilities $ 4,120,000

Again, assuming minimal administrative expenses, the estimated return to unsecured creditors for Sub-

sidiary B would approximate 73%.

Total assets $ 3,574,000

Less: secured asset (asset is only reduced by portion of amount owing as secured debt) (1,600,000)

Less: 77.5% of intercompany receivable (the intercompany receivable is only 22.5% col- (134,850)

lectible due to bankruptcy of Parent A)

Assets available for distribution $ 1,839,150

Total liabilities $ 4,120,000

Less: secured liabilities to amount of real estate value (1,600,000)

Unsecured debt $ 2,520,000

Estimated payout = $1,839,150/$2,520,000 = 73%

If Parent A and Subsidiary B are substantively consolidated, the combined payout would be approxi-

mately 45%.

152 © 2020 Association of International Certified Professional Accountants