Page 156 - Bankruptcy Volume 1

P. 156

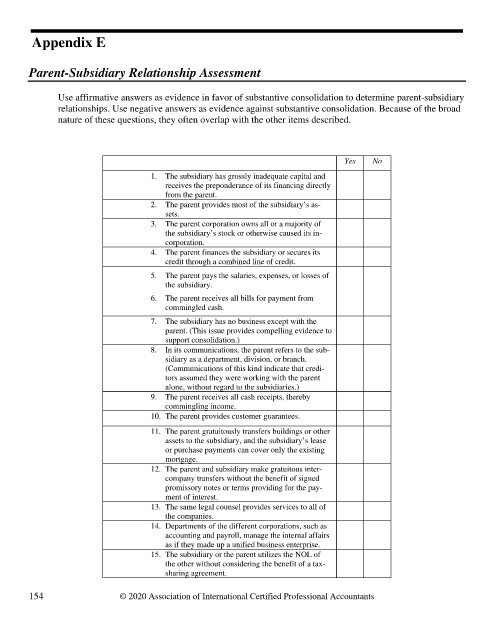

Appendix E

Parent-Subsidiary Relationship Assessment

Use affirmative answers as evidence in favor of substantive consolidation to determine parent-subsidiary

relationships. Use negative answers as evidence against substantive consolidation. Because of the broad

nature of these questions, they often overlap with the other items described.

Yes No

1. The subsidiary has grossly inadequate capital and

receives the preponderance of its financing directly

from the parent.

2. The parent provides most of the subsidiary’s as-

sets.

3. The parent corporation owns all or a majority of

the subsidiary’s stock or otherwise caused its in-

corporation.

4. The parent finances the subsidiary or secures its

credit through a combined line of credit.

5. The parent pays the salaries, expenses, or losses of

the subsidiary.

6. The parent receives all bills for payment from

commingled cash.

7. The subsidiary has no business except with the

parent. (This issue provides compelling evidence to

support consolidation.)

8. In its communications, the parent refers to the sub-

sidiary as a department, division, or branch.

(Communications of this kind indicate that credi-

tors assumed they were working with the parent

alone, without regard to the subsidiaries.)

9. The parent receives all cash receipts, thereby

commingling income.

10. The parent provides customer guarantees.

11. The parent gratuitously transfers buildings or other

assets to the subsidiary, and the subsidiary’s lease

or purchase payments can cover only the existing

mortgage.

12. The parent and subsidiary make gratuitous inter-

company transfers without the benefit of signed

promissory notes or terms providing for the pay-

ment of interest.

13. The same legal counsel provides services to all of

the companies.

14. Departments of the different corporations, such as

accounting and payroll, manage the internal affairs

as if they made up a unified business enterprise.

15. The subsidiary or the parent utilizes the NOL of

the other without considering the benefit of a tax-

sharing agreement.

154 © 2020 Association of International Certified Professional Accountants