Page 23 - FlipBook BACK FROM SARAN - MAY 5 2020 - Don't Make Me Say I Told You So_6.14x9.21_v9_Neat

P. 23

Don’t Make Me Say I Told You So 9

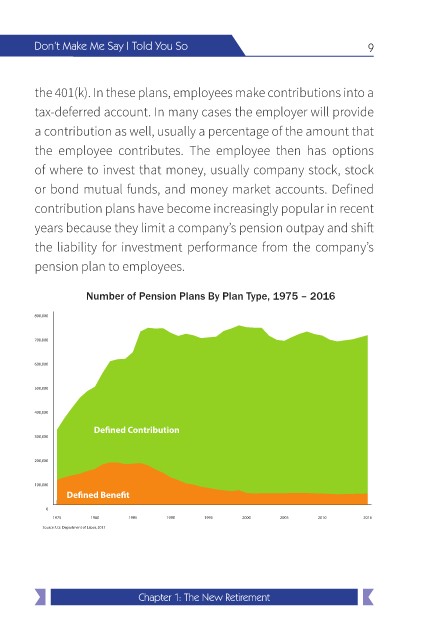

the 401(k). In these plans, employees make contributions into a

tax-deferred account. In many cases the employer will provide

a contribution as well, usually a percentage of the amount that

the employee contributes. The employee then has options

of where to invest that money, usually company stock, stock

or bond mutual funds, and money market accounts. Defined

contribution plans have become increasingly popular in recent

years because they limit a company’s pension outpay and shift

the liability for investment performance from the company’s

pension plan to employees.

Number of Pension Plans By Plan Type, 1975 – 2016

800,000

65-year-old man 65-year-old woman 65-year-old couple

700,000

600,000

500,000

400,000

De ned Contribution

300,000

200,000

100,000

De ned Bene t

0

1975 1980 1985 1990 1995 2000 2005 2010 2016

Source: U.S. Department of Labor, 2017

Chapter 1: The New Retirement