Page 100 - GTBANK GAMNBIA 2021 ANNUAL REPORT

P. 100

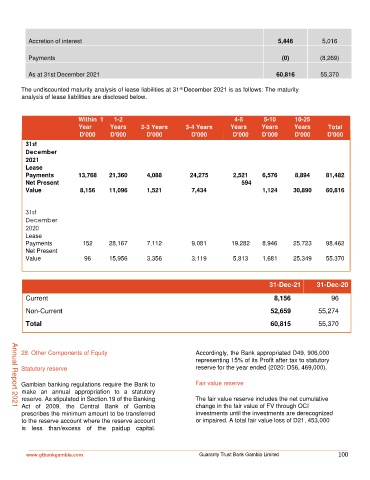

Accretion of interest 5,446 5,016

Payments (0) (8,269)

As at 31st December 2021 60,816 55,370

st

The undiscounted maturity analysis of lease liabilities at 31 December 2021 is as follows: The maturity

analysis of lease liabilities are disclosed below.

Within 1 1-2 4-5 5-10 10-25

Year Years 2-3 Years 3-4 Years Years Years Years Total

D'000 D'000 D'000 D'000 D'000 D'000 D'000 D'000

31st

December

2021

Lease

Payments 13,768 21,360 4,088 24,275 2,521 6,576 8,894 81,482

Net Present 594

Value 8,156 11,096 1,521 7,434 1,124 30,890 60,816

31st

December

2020

Lease

Payments 152 28,167 7,112 9,081 19,282 8,946 25,723 98,462

Net Present

Value 96 15,956 3,356 3,119 5,813 1,681 25,349 55,370

31-Dec-21 31-Dec-20

Current 8,156 96

Non-Current 52,659 55,274

Total 60,815 55,370

28. Other Components of Equity Accordingly, the Bank appropriated D49, 906,000

representing 15% of its Profit after tax to statutory

Statutory reserve reserve for the year ended (2020: D56, 469,000).

Gambian banking regulations require the Bank to Fair value reserve

make an annual appropriation to a statutory

reserve. As stipulated in Section.19 of the Banking The fair value reserve includes the net cumulative

Act of 2009, the Central Bank of Gambia change in the fair value of FV through OCI

Annual Report 2021

prescribes the minimum amount to be transferred investments until the investments are derecognized

to the reserve account where the reserve account or impaired. A total fair value loss of D21, 453,000

is less than/excess of the paidup capital.

www.gtbankgambia.com Guaranty Trust Bank Gambia Limited 100