Page 80 - GTBank Annual Report 2020 eBook

P. 80

capital (1.25% of risk assets and hybrid the business. The impact of the level of capital on

instruments – convertible bonds). Banking shareholders’ return is also recognized and the

operations are categorized mainly as trading bank recognizes the need to maintain a balance

book or banking book, and risk-weighted assets between the higher returns that might be possible

are determined according to specific with greater gearing and the advantages and

requirements that seek to reflect the varying security afforded by a sound capital position.

levels of risk attached to the assets and off-

financial position exposures. The Bank and its individually regulated

operations has complied with all externally

The Bank’s policy is to maintain a strong capital imposed capital requirements throughout the

base so as to maintain investor, credit and market year. There have been no material changes in the

confidence and to sustain future development of Bank’s management of capital during the year.

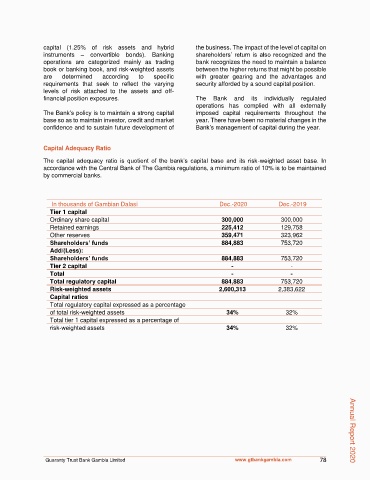

Capital Adequacy Ratio

The capital adequacy ratio is quotient of the bank’s capital base and its risk-weighted asset base. In

accordance with the Central Bank of The Gambia regulations, a minimum ratio of 10% is to be maintained

by commercial banks.

In thousands of Gambian Dalasi Dec.-2020 Dec.-2019

Tier 1 capital

Ordinary share capital 300,000 300,000

Retained earnings 225,412 129,758

Other reserves 359,471 323,962

Shareholders’ funds 884,883 753,720

Add/(Less):

Shareholders’ funds 884,883 753,720

Tier 2 capital - -

Total - -

Total regulatory capital 884,883 753,720

Risk-weighted assets 2,600,313 2,383,622

Capital ratios

Total regulatory capital expressed as a percentage

of total risk-weighted assets 34% 32%

Total tier 1 capital expressed as a percentage of

risk-weighted assets 34% 32%

Annual Report 2020

Guaranty Trust Bank Gambia Limited www.gtbankgambia.com 78