Page 77 - GTBank Annual Report 2020 eBook

P. 77

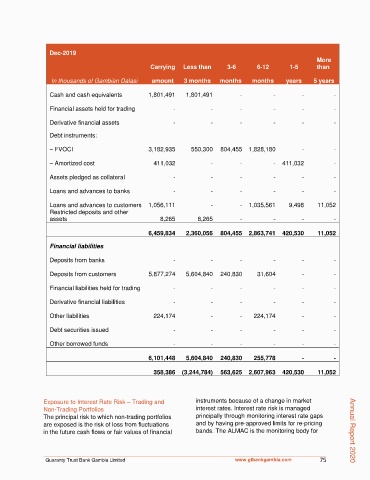

Dec-2019

More

Carrying Less than 3-6 6-12 1-5 than

In thousands of Gambian Dalasi amount 3 months months months years 5 years

Cash and cash equivalents 1,801,491 1,801,491 - - - -

Financial assets held for trading - - - - - -

Derivative financial assets - - - - - -

Debt instruments:

– FVOCI 3,182,935 550,300 804,455 1,828,180 - -

– Amortized cost 411,032 - - - 411,032 -

Assets pledged as collateral - - - - - -

Loans and advances to banks - - - - - -

Loans and advances to customers 1,056,111 - - 1,035,561 9,498 11,052

Restricted deposits and other

assets 8,265 8,265 - - - -

6,459,834 2,360,056 804,455 2,863,741 420,530 11,052

Financial liabilities

Deposits from banks - - - - - -

Deposits from customers 5,877,274 5,604,840 240,830 31,604 - -

Financial liabilities held for trading - - - - - -

Derivative financial liabilities - - - - - -

Other liabilities 224,174 - - 224,174 - -

Debt securities issued - - - - - -

Other borrowed funds - - - - - -

6,101,448 5,604,840 240,830 255,778 - -

358,386 (3,244,784) 563,625 2,607,963 420,530 11,052

Exposure to Interest Rate Risk – Trading and instruments because of a change in market

Non-Trading Portfolios interest rates. Interest rate risk is managed

The principal risk to which non-trading portfolios principally through monitoring interest rate gaps

are exposed is the risk of loss from fluctuations and by having pre-approved limits for re-pricing

in the future cash flows or fair values of financial bands. The ALMAC is the monitoring body for Annual Report 2020

Guaranty Trust Bank Gambia Limited www.gtbankgambia.com 75