Page 74 - GTBank Annual Report 2020 eBook

P. 74

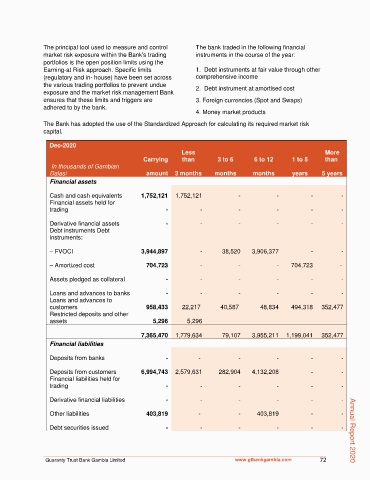

The principal tool used to measure and control The bank traded in the following financial

market risk exposure within the Bank's trading instruments in the course of the year:

portfolios is the open position limits using the

Earning-at Risk approach. Specific limits 1. Debt instruments at fair value through other

(regulatory and in- house) have been set across comprehensive income

the various trading portfolios to prevent undue 2. Debt instrument at amortised cost

exposure and the market risk management Bank

ensures that these limits and triggers are 3. Foreign currencies (Spot and Swaps)

adhered to by the bank.

4. Money market products

The Bank has adopted the use of the Standardized Approach for calculating its required market risk

capital.

Dec-2020

Less More

Carrying than 3 to 6 6 to 12 1 to 5 than

In thousands of Gambian

Dalasi amount 3 months months months years 5 years

Financial assets

Cash and cash equivalents 1,752,121 1,752,121 - - - -

Financial assets held for

trading - - - - - -

Derivative financial assets - - - - - -

Debt instruments Debt

instruments:

– FVOCI 3,944,897 - 38,520 3,906,377 - -

– Amortized cost 704,723 - - - 704,723 -

Assets pledged as collateral - - - - - -

Loans and advances to banks - - - - - -

Loans and advances to

customers 958,433 22,217 40,587 48,834 494,318 352,477

Restricted deposits and other

assets 5,296 5,296

7,365,470 1,779,634 79,107 3,955,211 1,199,041 352,477

Financial liabilities

Deposits from banks - - - - - -

Deposits from customers 6,994,743 2,579,631 282,904 4,132,208 - -

Financial liabilities held for

trading - - - - - -

Derivative financial liabilities - - - - - -

Other liabilities 403,819 - - 403,819 - -

Debt securities issued - - - - - - Annual Report 2020

Guaranty Trust Bank Gambia Limited www.gtbankgambia.com 72