Page 98 - GTBank Annual Report 2020 eBook

P. 98

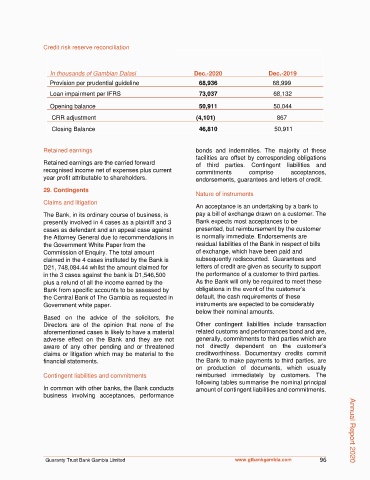

Credit risk reserve reconciliation

In thousands of Gambian Dalasi Dec.-2020 Dec.-2019

Provision per prudential guideline 68,936 68,999

Loan impairment per IFRS 73,037 68,132

Opening balance 50,911 50,044

CRR adjustment (4,101) 867

Closing Balance 46,810 50,911

Retained earnings bonds and indemnities. The majority of these

facilities are offset by corresponding obligations

Retained earnings are the carried forward of third parties. Contingent liabilities and

recognised income net of expenses plus current commitments comprise acceptances,

year profit attributable to shareholders. endorsements, guarantees and letters of credit.

29. Contingents

Nature of instruments

Claims and litigation

An acceptance is an undertaking by a bank to

The Bank, in its ordinary course of business, is pay a bill of exchange drawn on a customer. The

presently involved in 4 cases as a plaintiff and 3 Bank expects most acceptances to be

cases as defendant and an appeal case against presented, but reimbursement by the customer

the Attorney General due to recommendations in is normally immediate. Endorsements are

the Government White Paper from the residual liabilities of the Bank in respect of bills

Commission of Enquiry. The total amount of exchange, which have been paid and

claimed in the 4 cases instituted by the Bank is subsequently rediscounted. Guarantees and

D21, 748,084.44 whilst the amount claimed for letters of credit are given as security to support

in the 3 cases against the bank is D1,546,500 the performance of a customer to third parties.

plus a refund of all the income earned by the As the Bank will only be required to meet these

Bank from specific accounts to be assessed by obligations in the event of the customer’s

the Central Bank of The Gambia as requested in default, the cash requirements of these

Government white paper. instruments are expected to be considerably

below their nominal amounts.

Based on the advice of the solicitors, the

Directors are of the opinion that none of the Other contingent liabilities include transaction

aforementioned cases is likely to have a material related customs and performances bond and are,

adverse effect on the Bank and they are not generally, commitments to third parties which are

aware of any other pending and or threatened not directly dependent on the customer’s

claims or litigation which may be material to the creditworthiness. Documentary credits commit

financial statements. the Bank to make payments to third parties, are

on production of documents, which usually

Contingent liabilities and commitments reimbursed immediately by customers. The

following tables summarise the nominal principal

In common with other banks, the Bank conducts amount of contingent liabilities and commitments.

business involving acceptances, performance

Annual Report 2020

Guaranty Trust Bank Gambia Limited www.gtbankgambia.com 96