Page 140 - Guardian Broker Questionnaire Summary Complete Package 2 2 22_Neat

P. 140

03 GUARDIAN PLACE

VALUATION

GUARDIAN PLACE II VALUATION SUMMARY

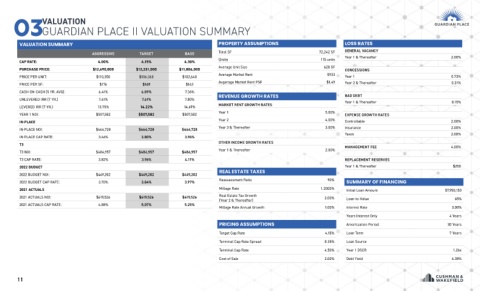

VALUATION SUMMARY PROPERTY ASSUMPTIONS LOSS RATES

AGGRESSIVE TARGET BASE Total SF 72,242 SF GENERAL VACANCY

Units 115 units Year 1 & Thereafter 2.00%

CAP RATE: 4.00% 4.15% 4.30%

PURCHASE PRICE: $12,690,000 $12,231,000 $11,804,000 Average Unit Size 628 SF CONCESSIONS

Average Market Rent $933

PRICE PER UNIT: $110,350 $106,360 $102,640 Year 1 0.73%

Avgerage Market Rent PSF $1.49 Year 2 & Thereafter 0.31%

PRICE PER SF: $176 $169 $163

CASH-ON-CASH (5 YR. AVG): 6.41% 6.89% 7.36%

REVENUE GROWTH RATES BAD DEBT

UNLEVERED IRR (7 YR.) 7.41% 7.61% 7.80% Year 1 & Thereafter 0.15%

LEVERED IRR (7 YR.) 13.75% 14.22% 14.69% MARKET RENT GROWTH RATES

YEAR 1 NOI: $507,582 $507,582 $507,582 Year 1 5.00% EXPENSE GROWTH RATES

IN-PLACE Year 2 4.00% Controllable 2.00%

IN-PLACE NOI: $464,728 $464,728 $464,728 Year 3 & Thereafter 3.00% Insurance 2.00%

Taxes 2.00%

IN-PLACE CAP RATE: 3.66% 3.80% 3.94%

OTHER INCOME GROWTH RATES

T3 MANAGEMENT FEE 4.00%

T3 NOI: $484,957 $484,957 $484,957 Year 1 & Thereafter 2.00%

T3 CAP RATE: 3.82% 3.96% 4.11% REPLACEMENT RESERVES

2022 BUDGET Year 1 & Thereafter $250

REAL ESTATE TAXES

2022 BUDGET NOI: $469,202 $469,202 $469,202

Reassessment Ratio 90%

2022 BUDGET CAP RATE: 3.70% 3.84% 3.97% SUMMARY OF FINANCING

2021 ACTUALS Millage Rate 1.2000% Initial Loan Amount $7,950,150

2021 ACTUALS NOI: $619,526 $619,526 $619,526 Real Estate Tax Growth 2.00% Loan-to-Value 65%

(Year 2 & Thereafter)

2021 ACTUALS CAP RATE: 4.88% 5.07% 5.25%

Millage Rate Annual Growth 1.00% Interest Rate 3.00%

Years Interest Only 4 Years

PRICING ASSUMPTIONS Amortization Period 30 Years

Target Cap Rate 4.15% Loan Term 7 Years

Terminal Cap Rate Spread 0.35% Loan Source

Terminal Cap Rate 4.50% Year 1 DSCR 1.26x

Cost of Sale 2.00% Debt Yield 6.38%

11