Page 138 - Guardian Broker Questionnaire Summary Complete Package 2 2 22_Neat

P. 138

03 VALUATION GUARDIAN PLACE

GUARDIAN PLACE I VALUATION SUMMARY

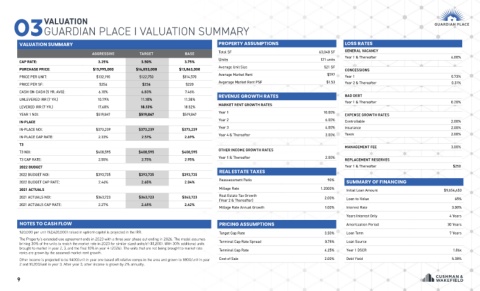

VALUATION SUMMARY PROPERTY ASSUMPTIONS LOSS RATES

AGGRESSIVE TARGET BASE Total SF 63,048 SF GENERAL VACANCY

Units 121 units Year 1 & Thereafter 4.00%

CAP RATE: 3.25% 3.50% 3.75%

PURCHASE PRICE: $15,995,000 $14,853,000 $13,863,000 Average Unit Size 521 SF CONCESSIONS

Average Market Rent $797

PRICE PER UNIT: $132,190 $122,750 $114,570 Year 1 0.73%

Avgerage Market Rent PSF $1.53 Year 2 & Thereafter 0.31%

PRICE PER SF: $254 $236 $220

CASH-ON-CASH (5 YR. AVG): 6.18% 6.83% 7.46%

REVENUE GROWTH RATES BAD DEBT

UNLEVERED IRR (7 YR.) 10.79% 11.10% 11.38% Year 1 & Thereafter 0.20%

LEVERED IRR (7 YR.) 17.68% 18.13% 18.52% MARKET RENT GROWTH RATES

YEAR 1 NOI: $519,847 $519,847 $519,847 Year 1 10.00% EXPENSE GROWTH RATES

IN-PLACE Year 2 6.00% Controllable 2.00%

IN-PLACE NOI: $373,239 $373,239 $373,239 Year 3 4.00% Insurance 2.00%

Year 4 & Thereafter 3.00% Taxes 2.00%

IN-PLACE CAP RATE: 2.33% 2.51% 2.69%

T3 MANAGEMENT FEE 3.00%

T3 NOI: $408,595 $408,595 $408,595 OTHER INCOME GROWTH RATES

T3 CAP RATE: 2.55% 2.75% 2.95% Year 1 & Thereafter 2.00% REPLACEMENT RESERVES

2022 BUDGET Year 1 & Thereafter $250

REAL ESTATE TAXES

2022 BUDGET NOI: $393,735 $393,735 $393,735

Reassessment Ratio 90%

2022 BUDGET CAP RATE: 2.46% 2.65% 2.84% SUMMARY OF FINANCING

2021 ACTUALS Millage Rate 1.2000% Initial Loan Amount $9,654,450

2021 ACTUALS NOI: $363,723 $363,723 $363,723 Real Estate Tax Growth 2.00% Loan-to-Value 65%

(Year 2 & Thereafter)

2021 ACTUALS CAP RATE: 2.27% 2.45% 2.62%

Millage Rate Annual Growth 1.00% Interest Rate 3.00%

Years Interest Only 4 Years

NOTES TO CASH FLOW PRICING ASSUMPTIONS Amortization Period 30 Years

$20,000 per unit ($2,420,000) raised in upfront capital is projected in the IRR. Target Cap Rate 3.50% Loan Term 7 Years

The Property’s extended use agreement ends in 2023 with a three year phase out ending in 2026. The model assumes

brining 30% of the units to match the market rate in 2023 for similar sized units/sf ($1,200). With 30% additional units Terminal Cap Rate Spread 0.75% Loan Source

brought to market in year 2, 3, and the final 10% in year 4 (2026). The units that are not being brought to market rate Terminal Cap Rate 4.25% Year 1 DSCR 1.06x

rents are grown by the assumed market rent growth.

Other income is projected to be $400/unit in year one based off relative comps in the area and grown to $800/unit in year Cost of Sale 2.00% Debt Yield 5.38%

2 and $1,200/unit in year 3. After year 3, other income is grown by 2% annually.

9