Page 74 - Hudson City Schools CAFR 2017

P. 74

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

NOTES TO THE BASIC FINANCIAL STATEMENTS

FOR THE FISCAL YEAR ENDED JUNE 30, 2017

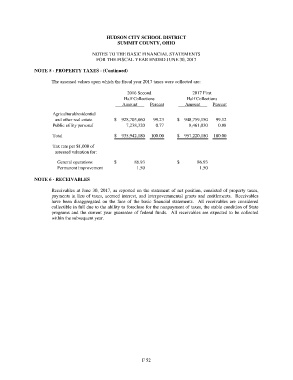

NOTE 5 - PROPERTY TAXES - (Continued)

The assessed values upon which the fiscal year 2017 taxes were collected are:

2016 Second 2017 First

Half Collections Half Collections

Amount Percent Amount Percent

Agricultural/residential

and other real estate $ 928,703,860 99.23 $ 948,759,150 99.12

Public utility personal 7,238,320 0.77 8,461,030 0.88

Total $ 935,942,180 100.00 $ 957,220,180 100.00

Tax rate per $1,000 of

assessed valuation for:

General operations $ 86.93 $ 86.93

Permanent improvement 1.50 1.50

NOTE 6 - RECEIVABLES

Receivables at June 30, 2017, as reported on the statement of net position, consisted of property taxes,

payments in lieu of taxes, accrued interest, and intergovernmental grants and entitlements. Receivables

have been disaggregated on the face of the basic financial statements. All receivables are considered

collectible in full due to the ability to foreclose for the nonpayment of taxes, the stable condition of State

programs and the current year guarantee of federal funds. All receivables are expected to be collected

within the subsequent year.

F 52