Page 75 - Hudson City Schools CAFR 2017

P. 75

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

NOTES TO THE BASIC FINANCIAL STATEMENTS

FOR THE FISCAL YEAR ENDED JUNE 30, 2017

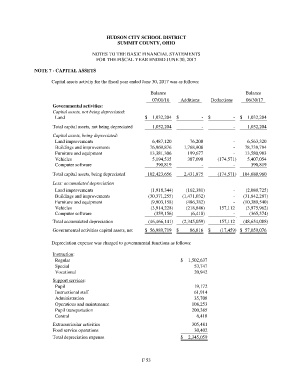

NOTE 7 - CAPITAL ASSETS

Capital assets activity for the fiscal year ended June 30, 2017 was as follows:

Balance Balance

07/01/16 Additions Deductions 06/30/17

Governmental activities:

Capital assets, not being depreciated:

Land $ 1,032,204 $ - $ - $ 1,032,204

Total capital assets, not being depreciated 1,032,204 - - 1,032,204

Capital assets, being depreciated:

Land improvements 6,487,120 76,200 - 6,563,320

Buildings and improvements 76,969,876 1,768,908 - 78,738,784

Furniture and equipment 13,381,306 199,677 - 13,580,983

Vehicles 5,194,535 387,090 (174,571) 5,407,054

Computer software 390,819 - - 390,819

Total capital assets, being depreciated 102,423,656 2,431,875 (174,571) 104,680,960

Less: accumulated depreciation

Land improvements (1,918,344) (162,381) - (2,080,725)

Buildings and improvements (30,371,255) (1,471,032) - (31,842,287)

Furniture and equipment (9,903,158) (486,382) - (10,389,540)

Vehicles (3,914,228) (218,846) 157,112 (3,975,962)

Computer software (359,156) (6,418) - (365,574)

0

Total accumulated depreciation (46,466,141) (2,345,059) 157,112 (48,654,088)

Governmental activities capital assets, net $ 56,989,719 $ 86,816 $ (17,459) $ 57,059,076

Depreciation expense was charged to governmental functions as follows:

Instruction:

Regular $ 1,502,637

Special 53,747

Vocational 20,942

Support services:

Pupil 19,172

Instructional staff 61,914

Administration 35,708

Operations and maintenance 108,253

Pupil transportation 200,385

Central 6,418

Extracurricular activities 305,481

Food service operations 30,402

Total depreciation expense $ 2,345,059

F 53