Page 19 - 2024 Employee Benefits Guide

P. 19

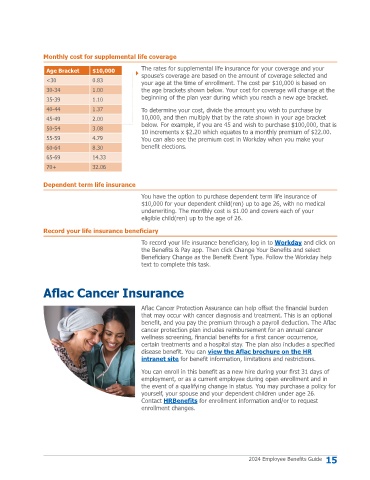

Monthly cost for supplemental life coverage

Age Bracket $10,000 The rates for supplemental life insurance for your coverage and your

spouse’s coverage are based on the amount of coverage selected and

<30 0.83 your age at the time of enrollment. The cost per $10,000 is based on

30-34 1.00 the age brackets shown below. Your cost for coverage will change at the

35-39 1.10 beginning of the plan year during which you reach a new age bracket.

40-44 1.37 To determine your cost, divide the amount you wish to purchase by

45-49 2.00 10,000, and then multiply that by the rate shown in your age bracket

below. For example, if you are 45 and wish to purchase $100,000, that is

50-54 3.08

10 increments x $2.20 which equates to a monthly premium of $22.00.

55-59 4.79 You can also see the premium cost in Workday when you make your

60-64 8.30 benefit elections.

65-69 14.33

70+ 32.06

Dependent term life insurance

You have the option to purchase dependent term life insurance of

$10,000 for your dependent child(ren) up to age 26, with no medical

underwriting. The monthly cost is $1.00 and covers each of your

eligible child(ren) up to the age of 26.

Record your life insurance beneficiary

To record your life insurance beneficiary, log in to Workday and click on

the Benefits & Pay app. Then click Change Your Benefits and select

Beneficiary Change as the Benefit Event Type. Follow the Workday help

text to complete this task.

Aflac Cancer Insurance

Aflac Cancer Protection Assurance can help offset the financial burden

that may occur with cancer diagnosis and treatment. This is an optional

benefit, and you pay the premium through a payroll deduction. The Aflac

cancer protection plan includes reimbursement for an annual cancer

wellness screening, financial benefits for a first cancer occurrence,

certain treatments and a hospital stay. The plan also includes a specified

disease benefit. You can view the Aflac brochure on the HR

intranet site for benefit information, limitations and restrictions.

You can enroll in this benefit as a new hire during your first 31 days of

employment, or as a current employee during open enrollment and in

the event of a qualifying change in status. You may purchase a policy for

yourself, your spouse and your dependent children under age 26.

Contact HRBenefits for enrollment information and/or to request

enrollment changes.

2024 Employee Benefits Guide 15