Page 673 - B2B All Year Round Vol.8

P. 673

DRIVERS OF DEVELOPMENT DRIVERS OF DEVELOPMENT

cars by the current VED bands. More than two to £110. The overall CO 2 banding structure of Table 4 UK net total VED receipts Company Car Tax

in three new cars pay no VED and almost one new and existing car VED regime has remained from all vehicles

in five existing cars pay £30 or less. Since April stable. Most motorists would recognise this as Company car tax has been linked to cars CO 2

2010 new car VED has remained £0 for a car a welcome stability during a period of significant 2001/02 2011/12 2014/15 ratings since 2002. Company cars typically have

emitting up to CO 2 130g/km. Also, for existing increases in total household and business costs. replacement cycles of up to three years, though

cars the three rate values up to CO 2 120 g/ The VED rate for a Band G car was £155 at June Graduated VED all cars 400 4,180 4,850 in some cases these have lengthened, possibly

km have not changed and the value for the CO 2 2010. By April 2015 it was £180, a rise of £25 in due to the recession. Also, since 2010, the regime

band 121 to 130g/km is up by just £20 from £90 five years. of which new cars - 210 170 has set significant benefit-in-kind incentives for

those businesses and employees using zero and

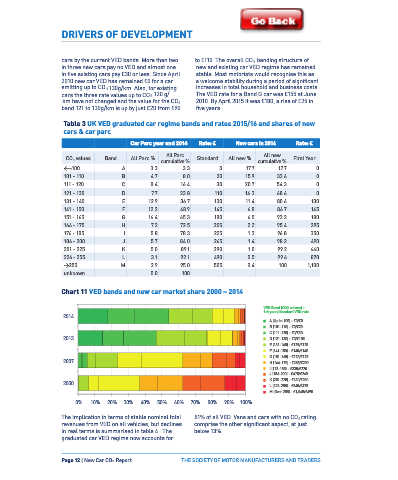

Table 3 UK VED graduated car regime bands and rates 2015/16 and shares of new Private and Light 3,500 1,270 750 ultra low emission vehicles. These incentives

Goods (PLG)

cars & car parc All VED all vehicles/ change and diminish significantly over the

licences 4,320 5,860 6,000 next five years. The essence of the changes is

Car Parc year end 2014 Rate: £ New cars in 2014 Rate: £ summarised in Table 6. By 2019/20 current plans

Source: DVLA financial data and SMMT estimates for the regime are for a 25% median-point of

All Parc All new an appropriate percentage of list price at a CO 2

CO values Band All Parc % cumulative % Standard All new % cumulative % First Year

2

VED Band (CO2 values) – rating of 105 to 109 – near the EU new car CO 2

17.7

2013 <=100 A 3.3 3.3 0 17.7 1st year/standard VED rate 0 regulation’s 95g/km EU-wide market average

33.6

101 - 110 B 4.7 8.0 20 15.9 A (Up to 100) - £0/£0 0 Capital Allowances specification. At 2013/14 the equivalent median

54.3

111 - 120 C 8.4 16.4 30 20.7 B (101-110) - £0/£20 0 tax-point was 165 to <=169 g/km. When the

C (111-120) - £0/£30 Since 2009 capital allowances, a cost relief for regime was first set in 2002/03 the appropriate

68.6

2012 121 - 130 D 7.7 23.8 110 14.3 D (121-130) - £0/£105 0 business investment against taxable profits, percentage rate’s 25% median point was

131 - 140 E 12.9 36.7 130 11.4 E (131-140) - £125/£125 130 has been referenced to cars CO 2 ratings referenced to a CO 2 rating of 215 to 219g/km. By

80.6

86.7

141 - 150 F 12.2 48.9 145 6.8 F (141-150) - £140/£140 145 and their status, new or used. The rates and

G (151-165) - £175/£175 this current tax year 2015/16, significant changes

93.2

2007 151 - 165 G 16.4 65.3 180 6.5 H (166-175) - £285/£200 180 corresponding CO 2 reference ratings for cars will also affect the lowest CO 2 emitting vehicles

166 - 175 H 7.2 72.5 205 2.2 I (176-185) - £335/£220 295 were stable from 2009 to 2013, but changed from and by 2019/20 the new or existing parc cars

95.4

96.8

176 - 185 I 5.8 78.3 225 1.3 J (186-200) - £475/£260 350 2013. The current rates are referenced to CO 2 with CO 2 emissions of up to 50g/km will see the

K (201-225) - £620/£280 ratings to 95g/km, 96 to 130, and 131 and over. A

98.2

186 - 200 J 5.7 84.0 265 1.4 L (226-255) - £840/£475 490 appropriate percentage of the car’s list price rise

2000 first year allowance is set at 100% for new cars from 5% at 2015/16 to 16%.

99.2

201 - 225 K 5.0 89.1 290 1.0 M (Over 255) - £1,065/£490 640 with ratings up to 95g/km; 18% for the main pool

226 - 255 L 3.1 92.1 490 0.5 99.6 870 of 96 to 130g/km and 8% for the special pool

0%

505

>255 20% M 40% 2.9 60% 95.0 80% 100% 100 1,100 of 131 and over. At Budget 2014 the coalition

0.4

unknown Market share 100 government extended the First Year Allowance Table 6 Company car taxation regime

5.0

for a further three years until 31 March 2018. 2013 to 2019P and 2014 parc and new

From April 2018, the carbon dioxide emissions

Chart 11 VED bands and new car market share 2000 – 2014 threshold will be cut from 95 g/km to 75 g/ cars shares in total

km. The table below, table 5, illustrates the car

capital allowances regime and its distribution in CO 2 2013/ All All 2015/ 2017/ 2019/

VED Band (CO2 values) – g/km 14 Parc New 16 18* 20

2013 1st year/standard VED rate terms of the UK car parc at the end of 2014 and appropriate percentage

2014

new car registrations in 2014.

A (Up to 100) - £0/£0

A (to 100) of car list price taxed

B (101-110) - £0/£20

B (101-110)

C (111-120) - £0/£30

C (111-120) 0 0 0.03% 0.27% 5 9 16

2013

2012 D (121-130)

D (121-130) - £0/£105

E (131-140) Table 5 UK capital allowances CO 2 <=50 5 0.04% 0.31% 5 9 16

E (131-140) - £125/£125

F (141-150)

F (141-150) - £140/£140

G (151-165) bands/rates and percentage shares of 51-75 5 0.01% 0.08% 9 15 19

G (151-165) - £175/£175

2007 H (166-175)

H (166-175) - £285/£200

2007 I (176-185) all new cars and car parc

I (176-185) - £335/£220

J (186-200) 18% - 96 to 131 g/km 76-94 10 0.36% 2.19% 13 17 22

J (186-200) - £475/£260

K (201-225) to 95g/km 130 g/km and over

K (201-225) - £620/£280

2000 L (226-255) 95-99 11 0.65% 3.52% 14 18 23

L (226-255) - £840/£475

2000 M (Over 255) 100%

M (Over 255) - £1,065/£490 allowance first year standard special 100-

type allowance allowance 104 12 2.21% 11.34% 15 19 24

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% allowance

0% 20% 40% 60% 80% 100% All car parc 105- 13 1.58% 6.82% 16 20 25

Market share at 2014 1.1% 18.5% 80.4% 109

The implication in terms of stable nominal total 81% of all VED. Vans and cars with no CO 2 rating All new

Market share

revenues from VED on all vehicles, but declines comprise the other significant aspect, at just cars in 2014 6.4% 62.2% 31.4%

in real terms is summarised in table 4 . The below 13%. Source: Budget Statements to March 2015

graduated car VED regime now accounts for

Page 12 | New Car CO 2 Report THE SOCIETY OF MOTOR MANUFACTURERS AND TRADERS THE SOCIETY OF MOTOR MANUFACTURERS AND TRADERS New Car CO 2 Report | Page 13